Since the COVID-19 pandemic, San Francisco has been navigating a difficult and lengthy road to recovery. Concerns over safety and street conditions, record-high office vacancies, a weak convention calendar, and limited visitation from Asia are among the challenges for local hoteliers. However, the long-term outlook remains cautiously optimistic given the growing presence of artificial intelligence companies, the fuller rebound of convention activity, and major sporting events planned for 2026, including Super Bowl LX and the FIFA World Cup.

Lodging, Convention, and Travel Trends

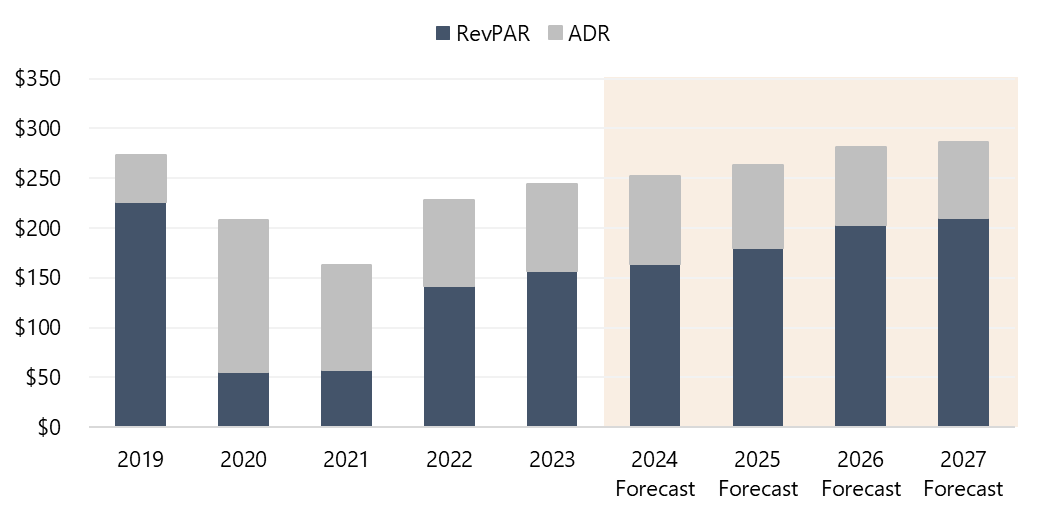

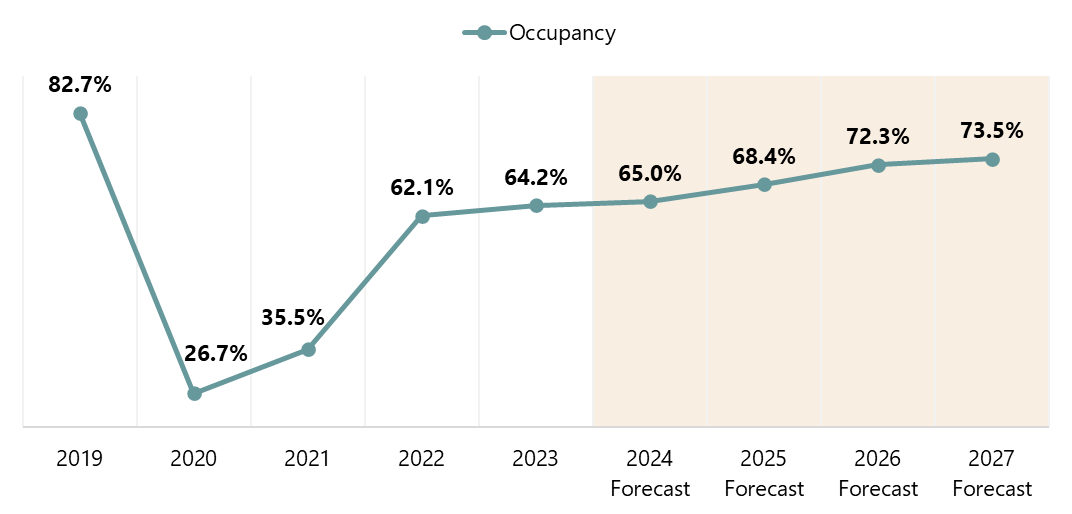

Following a rebound in 2022, San Francisco’s hotel performance continued to improve in 2023, with revenue per available room (RevPAR) reaching approximately 70% of the 2019 level. Major conferences such as the J.P. Morgan Annual Healthcare Conference and Dreamforce, as well as events such as the Asia-Pacific Economic Cooperation, were crucial to the city’s hospitality industry. As this article will explore, the city continues to face a number of challenges that are not anticipated to be resolved in the near term. Thus, hotel performance should grow minimally by year-end 2024. Over the longer term, San Francisco’s role as a gateway city for business, its profile as one of the premier convention destinations in the U.S., the strength of the high-technology sector, and the array of leisure attractions in the area should support the ongoing recovery, with RevPAR forecast to recover between 2027 and 2028.

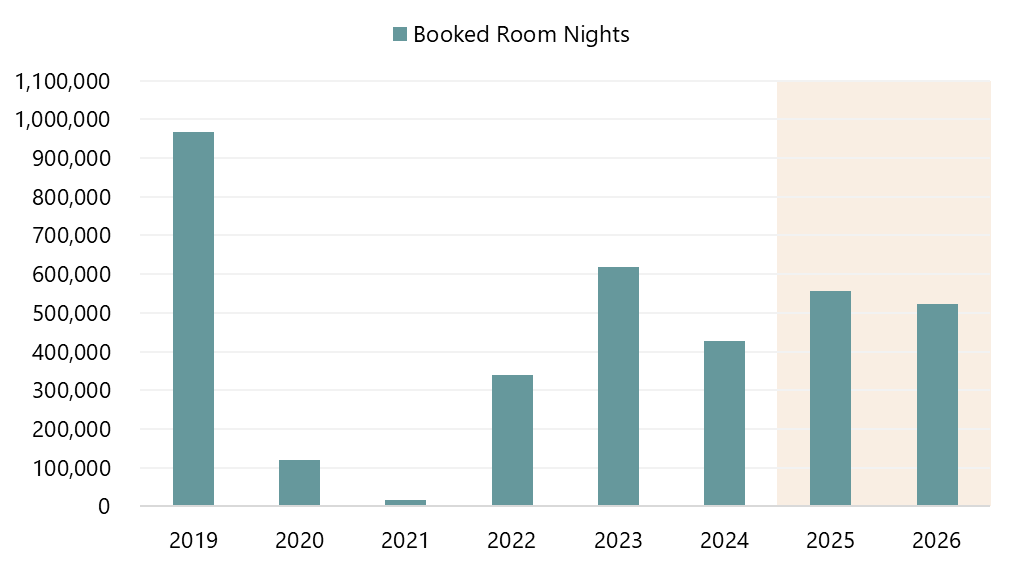

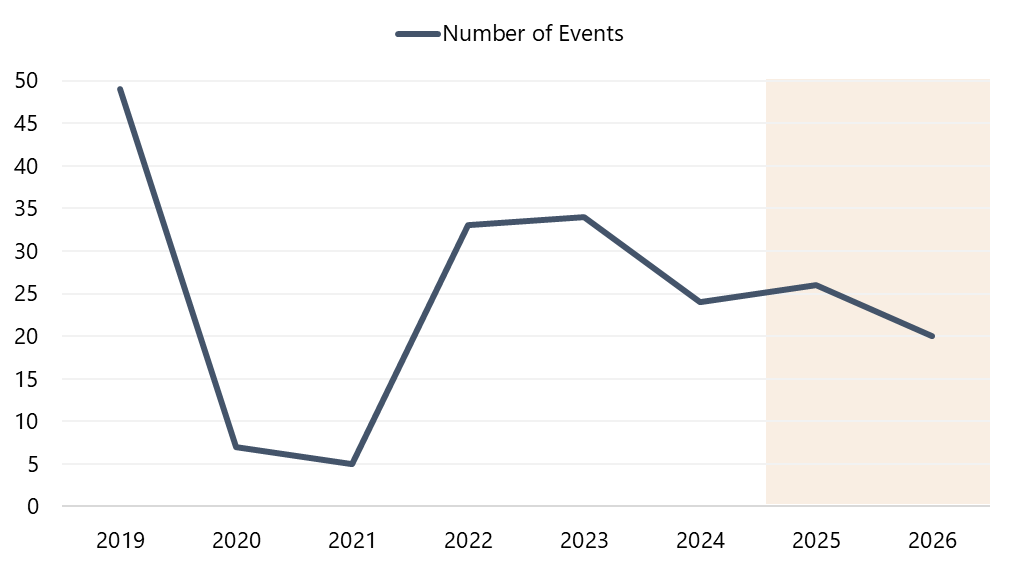

The historical and forecasted hotel metrics for the city are illustrated in the following tables, as published by the San Francisco Travel Association (SF Travel).

Convention trends declined in 2024; since large events are typically planned a few years in advance, a limited number of conventions were planned in advance for 2024 due to the two years of shutdown during the pandemic when the operator was unable to sell the venue. Earlier this year, SF Travel’s goals for the Moscone Center were reported at 650,000 annual room nights from 2025 to 2027 as the city continues to recover from pandemic-related disruptions. Reportedly, SF Travel’s target increases to 850,000 nights by 2028 and 2029, in line with Moscone’s historical level of production.

The rise of artificial intelligence (AI) has resulted in new convention business for San Francisco. One recent AI conference, Snowflake’s Data Cloud Summit, attracted approximately 20,000 attendees in June 2024. The summit contributed over 18,000 hotel room nights, with an anticipated direct spending of $20.9 million and a total economic impact of $30.0 million. This event, marketed as the world’s largest data and AI conference, was previously held in Las Vegas; however, Snowflake has committed to San Francisco’s Moscone Center through 2026. Denise Persson, Snowflake’s Chief Marketing Officer, listed the key reasons for the relocation as San Francisco’s status as an AI hub, Moscone’s capacity, and the availability of direct flights from Asia. Despite the decline in events planned for 2026, Moscone is anticipating a stronger level of attendees and associated room nights. This is most likely because Moscone will host several notable events in 2026, including the Pokémon World Championships and the Super Bowl Experience for Super Bowl LX. Recurring events like the RSA Conference and Salesforce Dreamforce are also anticipated to increase in size compared to prior years.

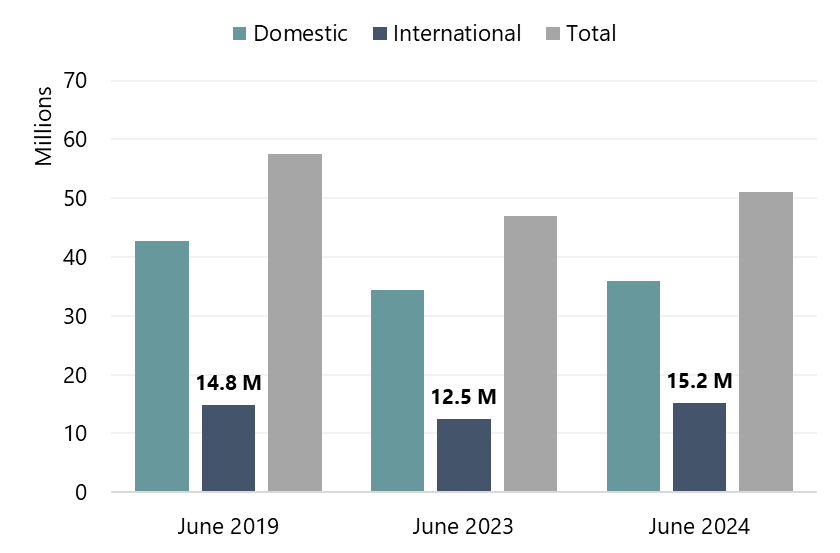

Demand from Asia, historically a key feeder region, has remained muted due to the current geopolitical climate and strong U.S. dollar. Nonetheless, in 2023, nonstop flights at San Francisco International Airport (SFO) to/from China resumed, and SFO welcomed the addition and return of many foreign airlines, including Air Transat, Breeze, Flair, ITA, Qatar, Vietnam, ZIPAIR, and Starlux. Although visitation from China remains below pre-pandemic levels, China regained its status as the top-spending international visitor market in San Francisco and San Mateo counties in 2023, with an estimated $633.4 million in visitor spending. Mexico, the U.K., Canada, Germany, and India represented the top five countries in terms of visitor volume in 2023. Overall international visitation increased by 23% year-over-year, with more than two million international visitors generating an estimated visitor expenditure of $4.64 billion. Demand from Asia is expected to be the first to recover as the rebound continues.

Source: San Francisco International Airport

According to SF Travel, San Francisco is expected to welcome roughly 2.35 million international visitors in 2024, with direct spending projected to reach $5 billion, accounting for more than half of total visitor expenditures. Passenger traffic at SFO is forecast to reach roughly 54 million passengers by year-end, which is nearly 95% of pre-pandemic levels. A $2.6-billion project to modernize Terminal 3 broke ground in August 2024 and is expected to open in the fall of 2027. The project will also include adding a six-story building with airline lounges and office space, anticipated to open in early 2028. Overall international visitation should continue to improve going forward, supported by increased air connectivity at SFO. Continued tourism campaigns and marketing efforts from SF Travel should also help this segment recover.

Ongoing Challenges

Despite year-over-year improvements in RevPAR, many of San Francisco’s fundamental economic challenges remain. Record office vacancies, limited foot traffic, concerns of street conditions, and a weaker than anticipated convention calendar have made some hotel investors wary of the San Francisco lodging market. The first half of 2023 saw widespread layoffs in the technology sector, as well as the failure of two regional banks. According to the state Employment Development Department, San Francisco’s unemployment level peaked in January 2024 and has since declined each month through April.

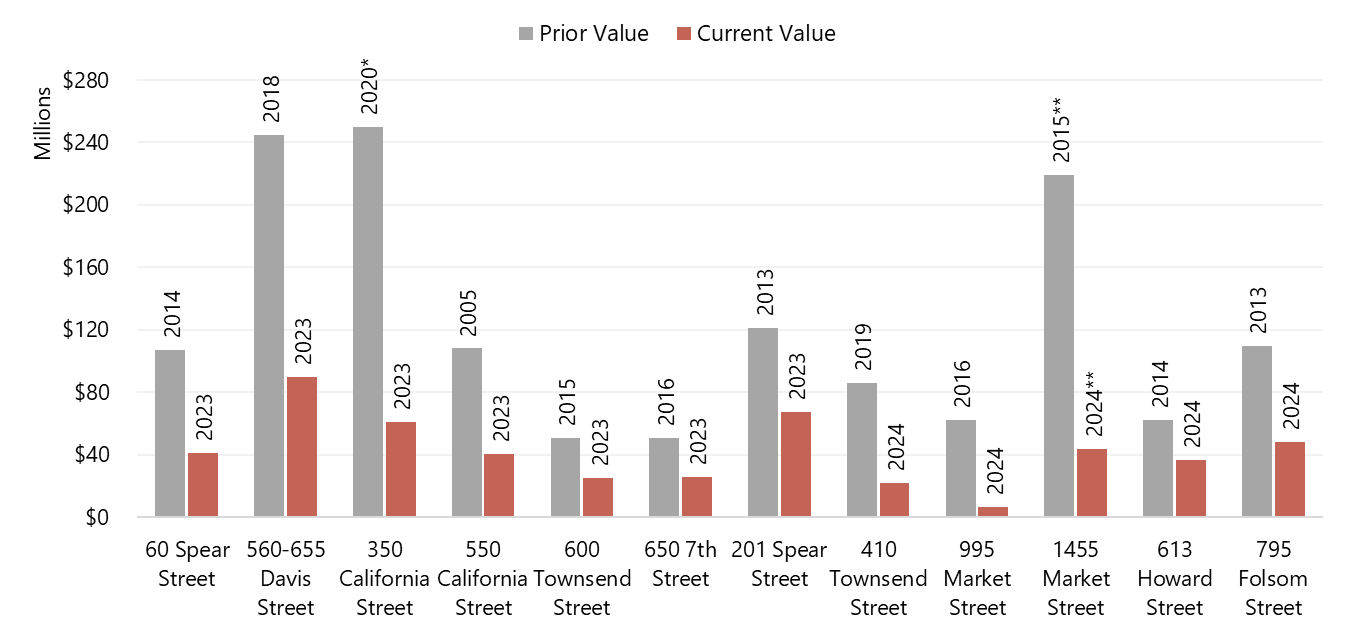

Because of the challenges facing the city, lodging analysts have extended the expected recovery timeline for San Francisco’s hotel market toward the end of the decade. Industry observers report that the city’s largest assets are experiencing valuation decreases of about 10% to 15% year-over-year, attributed to rising insurance rates and the slower recovery of key hospitality segments.

Decline in Office Building Values and Commercial Demand

San Francisco office vacancy in Q2 2024 reached a record high of 36.8%, according to CBRE. The average asking lease rate experienced a decline when compared to Q2 2023. However, Q2 2024 marked the second-best leasing quarter over the past two years, with approximately two million square feet of leasing activity. Office vacancies are forecast to peak over the next few quarters, and increasing leasing activity is expected to be driven by renewals and relocations of existing tenants in the city.

Most of the transactions in 2023 and the year-to-date 2024 period have closed at significant discounts from previous valuations, as the San Francisco office investment market resets itself amid the increase in vacancy levels. The table below shows some examples of these price drops. Nonetheless, Cushman & Wakefield expects transaction volume to increase throughout 2024 as more investors enter the market at discounted pricing.

*Prior asking price

**Price for 45% stake

Sources: The San Francisco Standard, The Real Deal, San Francisco Chronicle, SFGATE.com, San Francisco YIMBY *

Although vacancies remain high, there has been an increase in demand for higher quality space in prime locations, driven by the recent AI boom. OpenAI reportedly subleased roughly 486,600 square feet of office space from Uber in October 2023. Adyen, an Amsterdam-based financial tech company, subleased 150,000 square feet of office space from Pinterest at 505 Brannan Street in March 2024. In April, software company Rippling moved into 430 California Street, taking over 123,000 square feet of space across the top nine floors that were formerly occupied by WeWork. The following month, Scale AI subleased approximately 175,000 square feet of office space from Airbnb Inc.

Traditional tenants in the finance and legal sectors are slowly returning as well. For example, Visa began moving into a brand-new, 300,000-square-foot office building in Mission Rock in May 2024. Venture capital firms have also committed to relocating to the city to be closer to the AI hub. Businesses can take advantage of the tenant-favorable market to expand their presence in San Francisco, which in turn can potentially drive new business for local hotels.

Overall, commercial hotel demand has improved as employees have begun to return to offices; however, many companies maintain hybrid working policies. This has caused office vacancy rates to remain elevated and commercial demand to remain below prior peaks. Continued regional and national economic growth, particularly from the new field of AI, should drive demand increases in the future.

Hotel Loan Defaults & Recent Hotel Transactions

In June 2023, Park Hotels & Resorts made headlines by announcing it would stop making payments on a $725-million CMBS loan backed by two of the largest hotels in the city: the 1,921-room Hilton San Francisco Union Square and 1,024-room Parc 55, a Hilton Hotel. Furthermore, the 346-room Club Quarters Hotel Embarcadero has been in special servicing with CWCapital since 2020. The San Francisco Business Times reported in October 2023 that the owner, The Blackstone Group, is in negotiations for a potential deed-in-lieu. A deed-in-lieu allows the owner of a property to transfer ownership to the lender and be relieved of the mortgage debt without going through formal foreclosure proceedings.

Furthermore, ownership of the 544-room Hilton San Francisco Financial District is seeking refinancing and may be forced to sell after defaulting on the property’s $97-million mortgage loan earlier this year. In the first half of 2024, Westbrook Partners defaulted on both the 277-room Four Seasons Hotel San Francisco at 757 Market Street and the 155-room Four Seasons Hotel San Francisco at Embarcadero at 222 Sansome Street.

On the transaction side, Pebblebrook Hotel Trust has sold five properties in San Francisco since 2020, most recently the Hotel Zoe Fisherman’s Wharf in November 2023. This hotel reportedly sold for $68.5 million, representing a nearly 50% discount from Pebblebrook’s estimated all-in basis of $136 million ($122 million purchase price in 2015, plus $16 million in additional capital expenditures).

The multi-family and retail sectors have also been affected by the ongoing challenges in the city. The appraised value of NEMA, a 754-unit apartment building, declined from $543.6 million in 2018 to $279.0 million in 2023, according to real estate data firm Trepp. This valuation reportedly puts the property at risk of foreclosure given its $384-million mortgage. In June 2023, Unibail-Rodamco-Westfield announced a default on the $558-million CMBS loan tied to the former Westfield San Francisco Centre, a retail shopping mall located in Downtown San Francisco.

Positive Developments

While some investors have chosen to leave San Francisco given uncertainties regarding its short-term economic outlook, many with a longer-term horizon remain optimistic. KHP Capital Partners purchased the former Le Meridien San Francisco from Park Hotels & Resorts for $221 million in 2021. The hotel underwent a complete renovation and was rebranded as The Jay, Autograph Collection, debuting in late November 2023. The former Villa Florence was also rebranded as The Barnes, Tapestry Collection affiliate in May 2023 following a property-wide renovation; AWH Partners purchased the Union Square hotel from Pebblebrook Hotel Trust for $87.5 million in 2021.

Moreover, rising vacancies in the retail sector have allowed new tenants to enter the San Francisco market. In August 2023, IKEA opened its first location in the city on Market Street, providing the Mid-Market neighborhood with some much-needed foot traffic. In May 2024, Nintendo announced the opening of a store at 331 Powell Street, within the Westin St. Francis on Union Square; the store will occupy 11,000 square feet of trophy retail space. That same month, H Mart, a Korean-American grocery chain, purchased the Oceanview Village Shopping Center for $37 million. Finally, Hamdi Ulukaya, the founder and CEO of the Chobani yogurt brand, has acquired Anchor Brewing Co., a historic brewery that closed in 2023. The billionaire reportedly plans to modernize and reopen the brewery, with hopes of expanding the operation in the future.

While San Francisco’s attractiveness as a destination has been affected by the lack of foot traffic and safety concerns, these recent and planned developments are the first steps to improving foot traffic in the downtown area. Moreover, in June 2024, Mayor London Breed unveiled a comprehensive action plan to revitalize the Union Square and Yerba Buena districts. The plan is designed to boost pedestrian traffic, reduce storefront vacancies, and leverage positive trends such as new restaurant and retail openings, as well as civic events. As foot traffic returns and public safety continues to improve, San Francisco should regain its reputation as a top-tier tourism and convention destination, thereby boosting the city’s hotel demand.

Conclusion

Despite a softer outlook for 2024 driven by a weaker convention calendar, the San Francisco lodging market has multiple tailwinds that should support its recovery over the long term. The City has launched several initiatives aimed at increasing travel to San Francisco, including a $6-million advertising campaign. Tourism is anticipated to improve as international flights continue to increase. A stronger convention calendar, coupled with major sporting events such as the Super Bowl and World Cup, support a brighter outlook for 2025 and 2026.

We continue to watch the factors affecting San Francisco lodging, and our many consulting engagements throughout the greater area allow us to keep our finger on the pulse of the market. For more information about the San Francisco Bay Area market or for help making informed investment decisions that align with your goals and risk tolerance, please contact John Berean, who oversees HVS operations in Northern California.