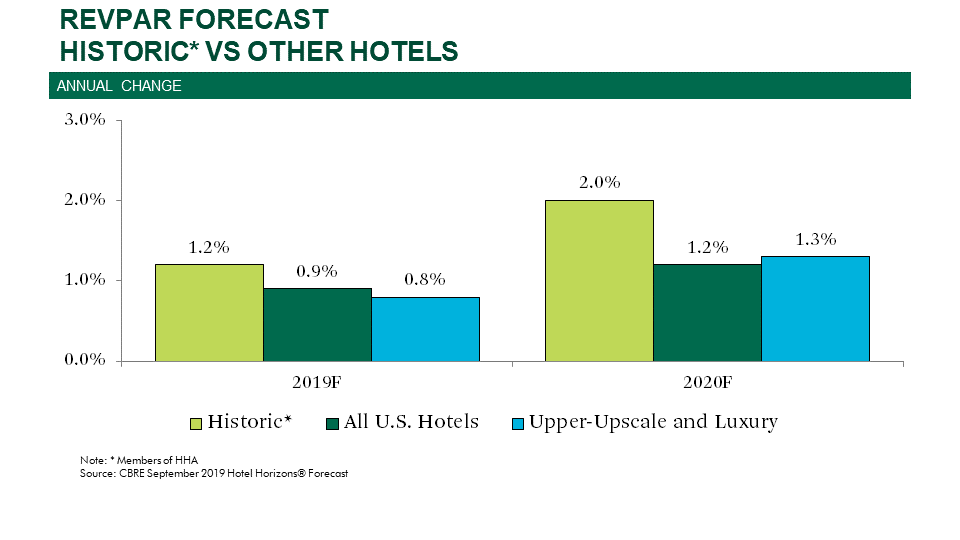

Historic Hotels forecast 1.2% advance in market RevPAR is better than the national projection of 0.8% increase for Upper-Upscale and Luxury Hotels.

WASHINGTON, DC – December 4, 2019 The outlook for the U.S. lodging industry continues to be less strong than prior years, according to CBRE Hotels Research (CBRE), but Historic Hotels RevPAR will be impacted less and be relatively stronger than other segments of the industry over the next two years.

For the sixth consecutive year, CBRE Hotels Research presented a Historic Hotels of America – CBRE two-year forecast at the Historic Hotels of America annual conference. CBRE relies on historical hotel performance data from STR, and economic forecasts from CBRE Econometric Advisors, to prepare its lodging forecasts.

Key points presented by Robert Mandelbaum, Director of Research Information Services, CBRE Hotels Research, to more than 240 owners, asset managers, general managers, and sales and marketing leaders at the Historic Hotels annual conference at Pinehurst Resort (1895) in North Carolina include:

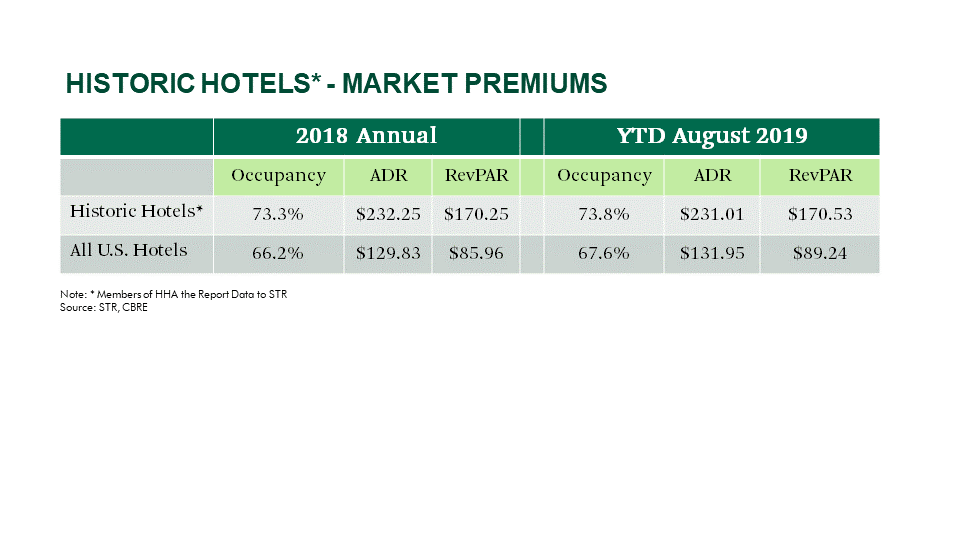

- Per STR, through August of 2019 the aggregate RevPAR for hotels that are members of Historic Hotels of America ($170.53) placed between the national averages for all upper-upscale ($142.67) and all luxury hotels ($252.48) in the U.S.

- Based on information pulled from CBRE’s database of hotel operating statements, Historic Hotels enjoyed superior revenue growth from 2014 to 2018 compared to comparable contemporary hotels. However, because they are operating within older buildings, Historic Hotels are burdened with greater maintenance and utility costs.

- Annual occupancy levels for hotels that are members of Historic Hotels of America are forecast to achieve an occupancy premium of 6.8 percentage points above the national average occupancy level through 2023.

- CBRE is forecasting a slowdown in the performance of the U.S. lodging industry from 2019 through 2021. On a comparative basis, the forecast deceleration in the compound annual growth for RevPAR at Historic Hotels (1.4%) will not be as deep as the projected RevPAR slowdown for luxury (0.9%) and upper-upscale (1.1%) properties during the period.

- Like all U.S. hotel operators, Historic Hotel managers will be challenged to control rising labor costs in an environment of sluggish revenue growth.

“Given the outlook for the U.S. economy for the next few years, we are forecasting a slowdown in the performance for the overall U.S. lodging industry through 2021. Fortunately, the popularity of Historic Hotels among travelers will allow these unique properties to maintain their occupancy premiums, thus muting the relative decelerating pace of RevPAR growth,” noted Mandelbaum.

“Even with a forecast slowing of the RevPAR growth rate and less optimum market conditions, the Historic Hotels forecast remains positive relative to the industry. One reason is that Historic Hotels of America helps the consumer differentiate the authentic historic hotel from other older hotels,” said Lawrence Horwitz, Executive Director, Historic Hotels of America and Historic Hotels Worldwide. “Historic hotels will continue to achieve a significant advantage in occupancy, ADR and RevPAR versus contemporary hotels, especially when recognized as part of Historic Hotels of America. While promoting its history helps a historic hotel differentiate itself from other hotels, being part of Historic Hotels of America validates the differentiation. For the sixth year in a row, historic hotels celebrating their heritage and history realize a competitive advantage as well as a substantial premium with their rates, occupancy and RevPAR compared to other hotels.”