Ezio Poinelli | February 21, 2024

By Lorenzo Gullotta, Giammarco Pignocchi, Ezio Poinelli

The city of Florence underwent a sustained period of tourism growth spanning over a decade, navigating various crises, including the 2008 financial crisis and subsequent economic recession in Italy, as well as the 2015 terrorism threat in Europe. However, the emergence of the COVID-19 pandemic marked a significant turning point. Like most destinations globally, Florence faced substantial challenges due to the pandemic and associated travel restrictions. Nevertheless, with the successful implementation of vaccination campaigns and the gradual relaxation of the containment measures throughout Europe and the United States, tourist numbers started to rebound as of April 2022. The city’s key performance indicators witnessed a remarkable improvement, culminating in 2023 emerging as a record-breaking year in terms of Revenue Per Available Room (RevPAR).

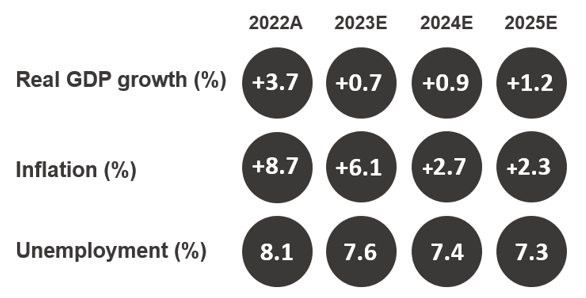

Economic Indicators – Italy

Source: European Commission

Airport Statistics

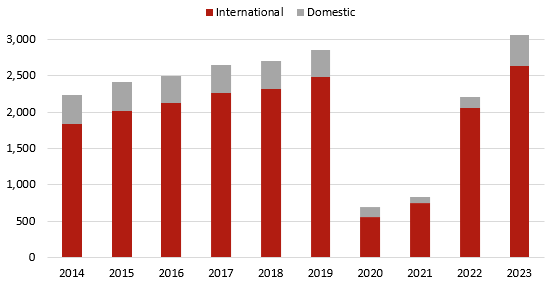

Formerly known as Amerigo Vespucci Airport,

Florence Peretola serves as the primary international gateway to Florence and stands as Tuscany’s second-largest airport by passenger volume, following

Pisa International Airport. From 2012 to 2019, the airport experienced sustained growth, with a Compound Annual Growth Rate (CAGR) of 6.5%, mainly due to the rising number of international travelers. Following the pandemic’s impact, the recovery began slowly in 2021 and gained momentum in 2022. As of the end of 2023, the recovery is complete, with passenger traffic having surpassed the 2019 figures by 7.1%. In contrast, Pisa International Airport, which saw a CAGR of 2.6% from 2012 to 2019, is still 5.2% below its 2019 levels. However, Pisa remains the region’s primary airport, with an annual passenger movement exceeding 5 million, compared to Florence’s approximately 3 million passengers.

Passenger Movement – Florence Peretola Airport (000s)

Source: Assaeroporti

Tourism Demand

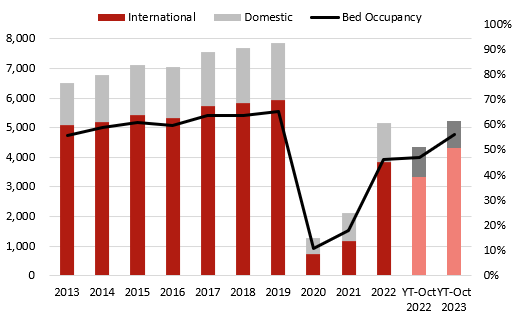

Between 2013 and 2019, hotel arrivals and bednights in Florence saw steady growth rates of 1.2% and 3.1% annually, respectively. This growth was mainly driven by an expanding domestic market recovering from the financial crisis. Consequently, gross bed occupancy rose from 56% to 65%. However, in 2020, arrivals and bednights experienced a sharp decline of approximately 80%. By the end of 2022, arrivals and bednights had recovered to 78% and 66% of 2019 levels, respectively. Preliminary data up to October 2023 indicate a further 20% year-on-year increase in both metrics, demonstrating sustained momentum. However, by year-end, we anticipate arrivals and bednights to still be below 2019 levels by 10% and 20%, respectively.

The discrepancy in recovery rates between hotel arrivals and airport passenger movement can be attributed to growing competition from the extra-hotel market, particularly vacation homes and farmhouses, which experienced significant growth following the pandemic. Additionally, this shift led to a noticeable decrease in the average length of stay at hotels, declining from 2.6 days in 2019 to 2.2 days in 2023.

In terms of nationality, the primary source market for Florence hotels in 2022 was the United States, driven by a favorable euro/dollar exchange rate, followed by France and the United Kingdom. However, Asian countries, notably China, have yet to fully return to pre-pandemic levels.

Accommodated Hotel Bednights and Gross Bed Occupancy (000s)

Source: Regione Toscana

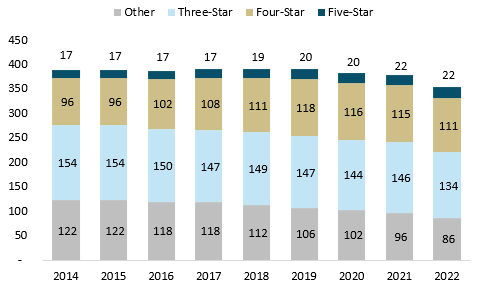

Hotel Supply and Pipeline

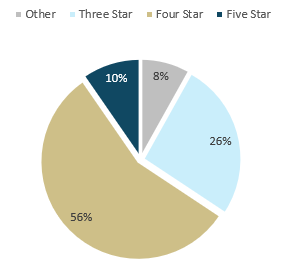

The hotel supply in Florence remained stable between 2014 and 2019 when it counted 391 hotels and 14,883 rooms. It is worth noting that throughout the same period, the four- and five-star segments grew in terms of hotels (at a CAGR of 4.2% and 3.3%, respectively) and rooms (CAGR of 2.5% and 2.6%), while supply in the lower segments experienced a steady decline. This pattern signifies a shift toward the upper market spectrum. The COVID-19 crisis further accelerated this transition, driving out several hotels in the lower market segments. As a result, the hotel supply shrunk between 2019 and 2022 by 38 hotels and 1,017 rooms.

The average size of Florence hotels is relatively small in terms of rooms. Five-star and four-star hotels average 60 and 70 rooms, respectively, while lower categories average around 22 rooms.

Hotel Supply 2014-22

Source: ISTAT

Hotel Rooms Supply 2022

Source: ISTAT

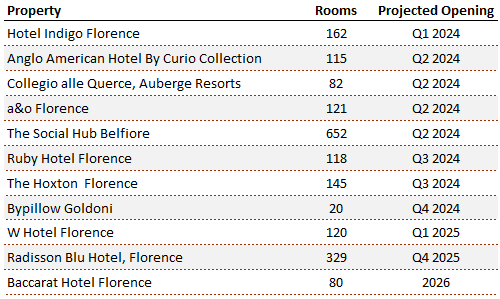

Looking ahead, Florence has a robust pipeline of around 2,000 rooms (approximately 14% of the existing supply), primarily in the four- and five-star segments, featuring several international brands, including renowned ultra-luxury names like

Auberge Resorts and

Baccarat, as well as additions from

Marriott,

Hilton,

Accor,

IHG and

Radisson. Notably,

The Social Hub Belfiore alone is set to contribute 652 rooms to the market.

There are also a few hotels that are about to be revamped, like the two Room Mate hotels (Room Mate Luca and Room Mate Isabella) that are currently undergoing renovations, and the NH Collection Palazzo Gaddi that is rebranding as a Tivoli Hotels and Resorts (both brands are under Minor Hotels).

Other noteworthy projects currently under discussion in Florence include the “ex-Scuola di Sanità Militare Vittorio Veneto”, which was purchased by Argentinian tycoon Alfredo Lowenstein and is envisioned to be converted into a luxury resort, and the “ex-Ospedale San Gallo”, purchased by GB Invest, which is planned be converted in a mixed-use establishment with private residences and a five-star hotel.

Hotel Pipeline

Source: HVS Research

Hotel Operating Performance

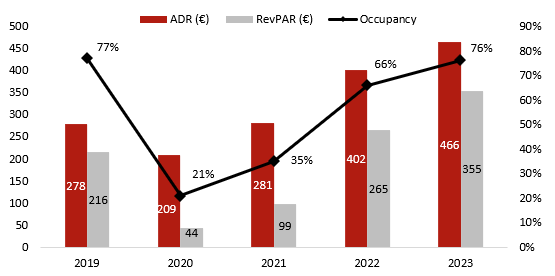

Examining a sample of approximately 3,000 luxury and upper upscale guestrooms reveals the remarkable recovery trajectory of the Florence hotel market. In 2020, the impact of the COVID-19 pandemic led to a significant drop in occupancy and a 25% decrease in average rates. The following year 2021 saw a partial rebound in occupancy levels (still below half of 2019), while the sample fully regained the lost ground in Average Daily Rate (ADR). In 2022, fueled by inflationary pressures and the return of international travelers, particularly from the United States, average rates surged by 43%. Despite occupancy levels still trailing 2019, RevPAR exceeded 2019 figures by 23%. In 2023, the upward ADR push continued (+16% year-over-year), reaching €466, and simultaneously occupancy fully recovered. Consequently, RevPAR experienced a 34% year-over-year increase and an impressive 64% surge since 2019.

KPIs – Upper Upscale and Luxury Hotels 2019-23

Hotel Investment Market

Despite being one of the “Big Four” tourist markets in Italy, the small average size of the hotels in Florence has traditionally discouraged certain international and institutional investors, who typically seek larger economies of scale. However, due to the recent improvements in hotel performance, the market has become increasingly appealing to this type of investor, who is now willing to consider properties with a lower room count. The table displays 18 of the most noteworthy transactions that occurred between 2015 and 2023. The largest transaction was the 2016 dual acquisition of the

St. Regis Florence and the

Westin Excelsior Florence by Qatari private investor

Jaidah Holdings from Starwood Hotels and Resorts (now Marriott) for €190 million (€701 thousand per room), while the highest price per room was achieved by

Palazzo Magnani Feroni in 2019 (€1,627,083). The most recent transaction on our records is the sale of the

Novotel Firenze Nord Aeroporto, in October 2023.

Hotel Transactions 2015-23

Outlook Florence

The hotel industry is rapidly evolving, reaching new levels of sophistication. This challenge spans from enhancing online presence to improving in-house guest experiences and physical accommodations. However, many hotels, especially those in lower market segments, struggle to keep up with the changes due to limited financial resources. Consequently, some hotels are finding themselves edged out of the market. In contrast, alternative accommodations like vacation homes have surged in popularity, offering competitive prices and catering well to families, groups, and long-stay travelers.

On the brighter side, the higher-end segments of the hotel market have demonstrated a heightened capacity to respond to evolving trends, and therefore successfully managed to capitalize on the significant pent-up demand for travel in 2022 and 2023, notably from the U.S. market, which returned to the city with a vengeance. This resulted in a remarkable surge in average rates, while occupancy levels rebounded to those seen in 2019.

Regarding hotel investments in Florence, entry barriers remain strong. Limited supply and strong demand have long made the city a desirable destination for hotel investors and the recent improvement in hotel performance further enhances the appeal of the hotel asset class. There is also a concern on the part of local administrations regarding the risk of over-tourism in the city center, and the current orientation is to put a brake on the phenomenon of vacation homes and the conversion of existing buildings into hotels by restricting the issuance of licenses in the historic center. While the outcome of the proposals currently under discussion is uncertain, it seems unavoidable that in the future, entry barriers will intensify. Given that Florence is a global icon of culture, architecture, design and lifestyle, it is foreseeable that the demand for accommodation will persistently outstrip supply in the future, progressively propelling the hotel market towards the upper market segments.

.PNG)