The following article gives a brief overview of Phuket, its tourism industry, and the recent dynamics of the local lodging market.

By Apichaya Wongsuwan, Ruj Masan, Pawinee Chaisiriroj

Following the market’s prosperity in the past few years, hotels across all segment have started to witness hindering economic growth, resulting in a softer performance in 2019. The unexpected outbreak of COVIC-19 has swept away the majority of the demand in the market. As the number of travel advisory continues to heighten, concerns over air traffic and tourism spending are increasing among the public as people are reluctant to travel. The following article gives a brief overview of Phuket, its tourism industry, and the recent dynamics of the local lodging market.

Phuket

Phuket, covering a total area of approximately 543 square kilometres, is Thailand’s largest island. Famous for its white-sand beaches, Phuket is located in the south of the country in the Andaman Sea and is connected to the mainland at Phang Nga province in the north of the island via the Sarasin Bridge. In the past, the island derived much of its wealth from tin and rubber whereas nowadays tourism dominates as the principal industry of the island’s economy.

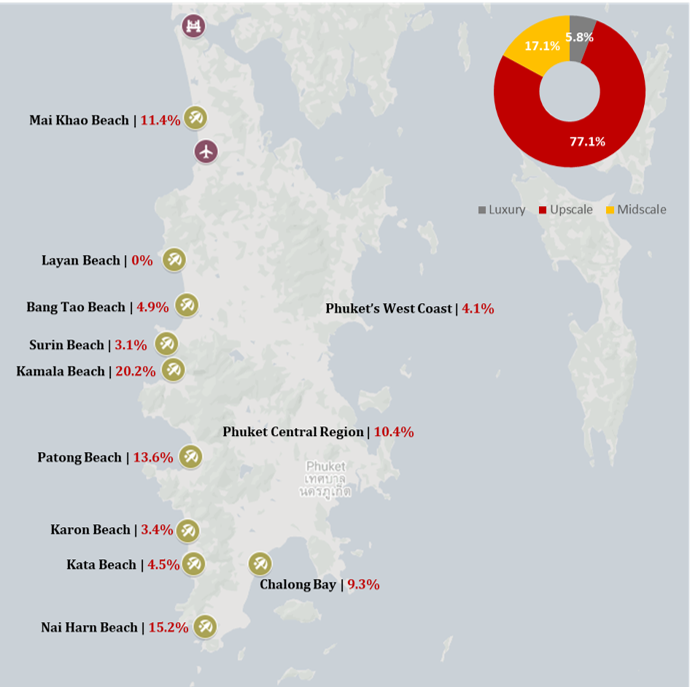

The majority of the beaches lie on the west coast of the island, including the notable ones at Mai Khao, Layan, Surin, Kamala, Patong, Karon, Kata, and Nai Harn. Mai Khao beach is the longest beach in Phuket, an area that has largely remained calm and peaceful thanks to its proximity to the Sirinat National Park. The only significant landmark in the area is the Phuket International Airport, enhancing Mai Khao’s accessibility to and from the island’s main transportation hub. Layan Beach is connected to Bang Tao Beach, and it is home to Laguna Phuket, one of the first masterplan developments on the island, featuring several branded resorts, residences, 18-hole golf course, and meeting and conference facilities. Surin beach is surrounded by a number of luxury resorts and residences in the area including Amanpuri, The Surin, and Twinpalms and generally has fewer visitors as some of the beach areas are shared among the hotels and only accessible by hotel guests.

Phuket Area Overview

Source: HVS Research

Kamala Beach houses Phuket Fantasea cultural theme park, which is considered to be the island’s biggest Thai cultural live show with approximately 3,000 attendees per night. A number of international branded hotels have already planned their presence in the area, including the recently opened InterContinental Phuket Resort. The area along Patong beach is considered to be the entertainment centre of Phuket, which is home to Bangla Walking Street and Jungceylon Shopping Centre. Karon beach is located south of Patong beach; however, it offers a quieter environment with good snorkelling spot in the southern end. Similar to Karon beach, Kata beach and Nai Harn beach are calm with limited entertainment scene.

The east coast and the southern region of the island are home to several educational attractions targeting families, such as the Phuket Aquarium and Phuket Zoo situated in Chalong Bay area, which is also popular among locals. Attractions that target tourists exclusively, such as Jungceylon Shopping Centre, Phuket FantaSea, and Phuket Simon Cabaret, tend to be located on the west coast where the majority of tourists reside. Central Festival Phuket reopened in September 2018 after a major renovation and is now known as Central Phuket. It features two shopping centres, a hotel with convention centre, as well as attractions such as ‘Mystic Forest’ – a futuristic wonderland green zone, ‘Aquaria’ – a walk-through aquarium – and a floating market called ‘Tales of Thailand’. Additionally, Central Group recently opened Central Patong in February 2019 with a total retail space of 35,000 m2, focusing on international visitors.

The Department of National Parks, Wildlife and Plant Conservation (DNP) has begun to reopen the Maya Bay at Koh Phi Phi Leh and is expected to welcome tourists back by November 2020. Maya Bay was closed to visitors in June 2018 due to the concerns of mass tourism, which adversely impacted the environment. The THB6.1 million Maya Bay Area Facility Development Project involves the construction of a new wooden pier at Maya Bay’s back entrance for speedboats and long-tail boats to moor. The new pier is expected to dock a maximum of eight boats at a time, which will set a daily cap. The THB11.6 million Landscape Improvement Project involves the construction of an elevated boardwalk, a designated walkway for tourists, allowing access to Loh Samah Bay and out onto a viewing platform at Ao Maya. Other features include smaller lookout terraces, new seating areas, bathroom facilities, and food and drink kiosks. As the government agency started to implement plans to promote responsible tourism, Phuket is thus set to embrace a shift from mass tourism activities to sustainable tourism.

Accessibility

Phuket enjoys good access by air, road, and sea. In recent years the island developed a good roadway network providing easy access to all parts of the island. However, the public transportation within the island is relatively limited, with local, open-air “Songtaew” (a passenger vehicle adapted from a pick-up truck) offering scheduled public transport from Phuket Town to the various beaches. A small number of metered taxis provide services from the airport; however, these are rarely found at other places throughout the island. Local Tuk Tuks are available in the main tourist areas; however, they tend to charge high fixed prices. Alternatively, Grab has become available in Phuket since 2016. The inauguration of Grab on the island is likely to reduce the number of unethical scams proposed by some unregulated taxi and Tuk Tuks driver. Grab launched GrabCar Phuket Daily Hire Service, allowing tourists to hire a car with a driver to travel around the island up to eight hours a day.

The three main marinas and various local piers provide embarkation and disembarkation points primarily for day-tours to surrounding islands rather than as an access point for sea travel from other places in Thailand. In order to support the tourism industry, the local authority is planning to set aside a budget for the improvement of public utilities system and infrastructure. Recently, major improvements have been made to the road network, such as the completion of the Darasamuth Underpass, the Samkong Underpass, the Bangku Underpass and the Chalong Circle Underpass, and the underpass at the airport intersection, which was completed in October 2019. Plans are also in progress for the much-anticipated 41.7-kilometre of the Phuket Mass Transit System by the Mass Rapid Transit Authority of Thailand (MRTA). The light rail is set to have 21 stations starting at Phuket International Airport and ending at Chalong Circle. The bidding for construction is expected to take place by mid-2020 and is scheduled for completion by 2025. This will be the first light rail project in Thailand outside of Bangkok. The alternative mode of transportation could face a potential pushback from the local taxi providers as they see it as a threat to their source of income. However, in the long run, improved transportation will ease traffic congestion, reduce the number of private car usage, and enhance the quality of life overall.

Phuket Airport

Located in the north of the island, Phuket International Airport (HKT) opened its new international terminal in September 2016, increasing its annual handling capacity from 6.5 million to 12.5 million passengers annually. Upgrades for the domestic terminal were completed in June 2018, prior to the upcoming high season. Nonetheless, reports indicate that the airport is still operating over capacity, handling over 18 million passengers, causing congestion, delay, and disruptions.

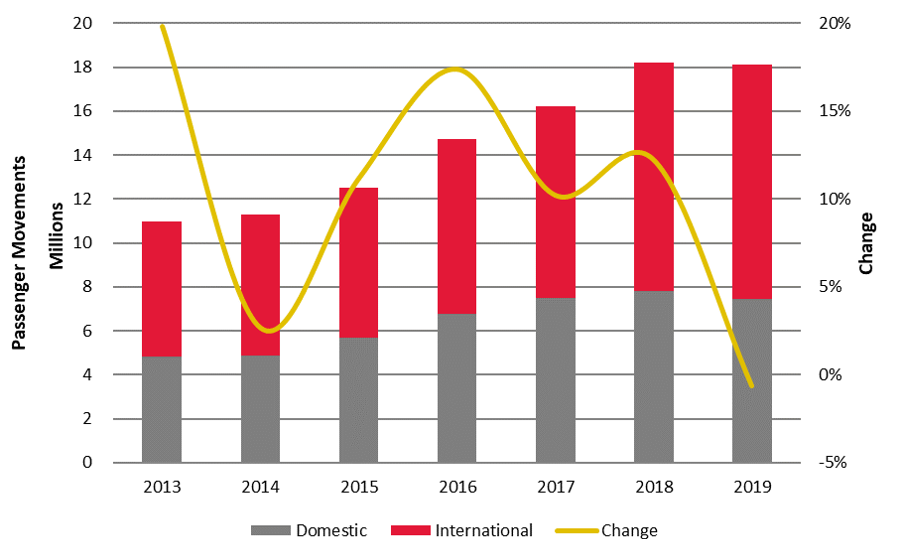

Figure 1: Tourist Passenger Movements, Phuket International Airport, 2013 – 2019

Source: Airports of Thailand

In order to ease the overcrowding passengers in the Andaman Triangle (Phuket, Krabi, and Phang Nga), the Airport of Thailand (AOT) plans to add a new airport in Phang Nga, which will act as Phuket’s second airport. The THB60 billion plan was approved in principle by the board of AOT in 2018 and received a push forward from the Deputy Prime Minister. According to a press release by Phang Nga office of Public Relations Department, the proposed airport is expected to inaugurate by 2030. Currently, the airport has approximately 95 arrival flights and 99 departure flight per day. It serves 54 airlines scheduled for a direct flight to 59 destinations in 22 countries, including the new direct flights from Phuket via GoAir between Delhi and Mumbai. The market is expected to see an increase in Indian travellers in the near future to fill many of the rooms left empty after Chinese demand ebbed. Eva Air plans to introduce a direct flight between Taiwan and Phuket, serving three round trip flights per week starting from April 2020; however, the plan has been postponed until further notice due to the outbreak of COVID-19.

Although the airport has seen a steady double-digit year-on-year (y-o-y) growth in the passenger movements prior to 2019, it witnessed a negative growth of 0.6% for the first time since 2005. This has resulted from a drop of 4.7% in domestic passenger movements and a minor increase of 2.5% in international passenger movements. The strengthen of Thai Baht appreciation against foreign currencies enabled domestic travellers to go abroad more cost-effective and conversely discouraged some international visitors, particularly Australians. Nevertheless, the total passenger movements grew at a rate of 8.7% per annum between 2013 and 2019.

Guest Arrivals at Accommodation Establishments

Although the political unrest of 2013 and 2014 mainly took place in Bangkok, it affected the entire country and Phuket guest arrivals remained flat. In 2015, the number of guest arrivals at accommodations establishments increased by 10.5%, reflecting the country’s recovery from the political crisis. Since then, the market has been growing steadily with a healthy rate of 3.0% per annum over a seven-year period since 2013, driven by a growing share of Chinese visitors.

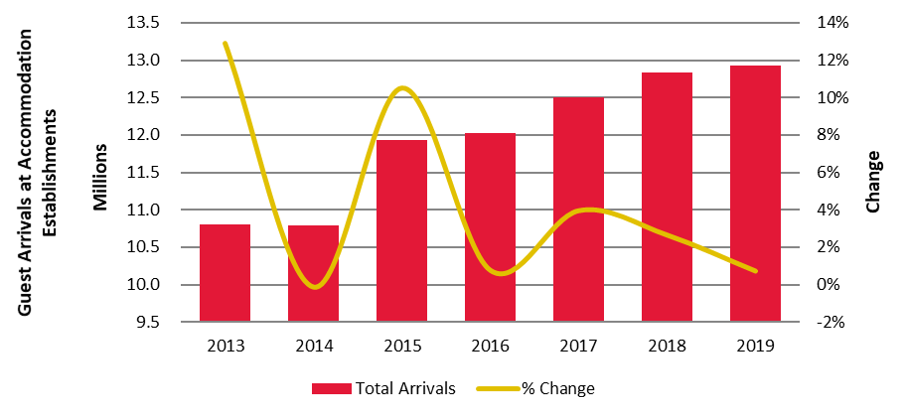

Figure 2: Guest Arrivals at Accommodation Establishments, Phuket, 2013 – 2019

Source: Department of Tourism

In 2019, the number reached 12.9 million, up 0.7% from 2018, indicating slower growth in comparison to 2.7% in 2018 and 4.0% in 2017. The limited growth in 2018 could be attributed to the boat incident in July, the general election and coronation at the beginning of 2019, as well as the appreciation of Thai Baht. The fluctuation of the foreign exchange is highly dependent on the overall health of the global economy, trade surplus, foreign reserved, and the policy from the Bank of Thailand as they cut the benchmark interest rate to a record low. In 2020, Phuket will witness a further steep decline in the number of guest arrivals at accommodation establishments due to the global impact of the COVID-19.

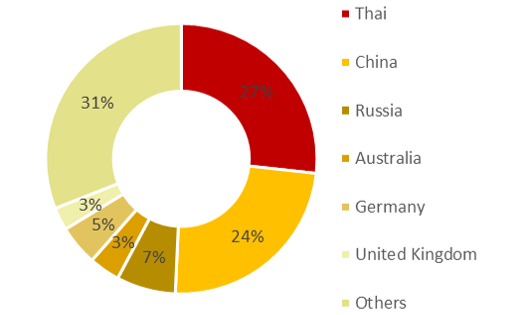

Source Market

Besides the domestic market, the Chinese continued to be the strongest source market to Phuket, although the growth rate of Chinese arrivals in 2018 was only 10.3% compared to the impressive 76.6%-growth recorded in 2015. Following the boat accident, Chinese arrivals dropped by 2.9% during the second half of 2018. Meanwhile, in the first seven months of 2019, the number of Chinese visitors further declined by 18.3% over the same period in the previous year. Furthermore, the strong Thai Baht that has risen by approximately ten percent against the Chinese Yuan in 2019 has discouraged Chinese tourists from visiting Thailand. Additionally, the trade tensions between the United States and China are further contributing to economic uncertainties and hampering tourism growth from this market.

Thailand has seen significant growth in the number of tourists from India, a 24.9% increase in 2019, recorded at almost 2.0 million, doubling the amount over the past five years. Although Bangkok and Pattaya were traditionally considered as a popular destination for Indian tourists, Phuket registered a significant increase in the number of tourists. Between 2017 and 2019 an increase of 286.8% was observed thanks to the 33 direct flights from New Delhi, Mumbai, and Bangalore to Phuket coupled with the visa on arrival fee exemption for Indian tourists since mid-November 2018. The visa-on-arrival fee waiver campaign period has been extended for another six months until April 2020. The recent prosperity of Indian travellers is similar to the Chinese about ten years ago due to the growing middle class with disposable income and the expansion of direct flights, as well as the government policy to induce the demand from India. Operators are trying to tap into the Indian market, yet it is still early days to see a significant impact on performance. At the time of publishing of this article, the year-end statistic for Phuket feeder markets for 2019 was not yet available.

Figure 3: Source Market, Phuket, 2018

Source: Department of Tourism

Seasonality

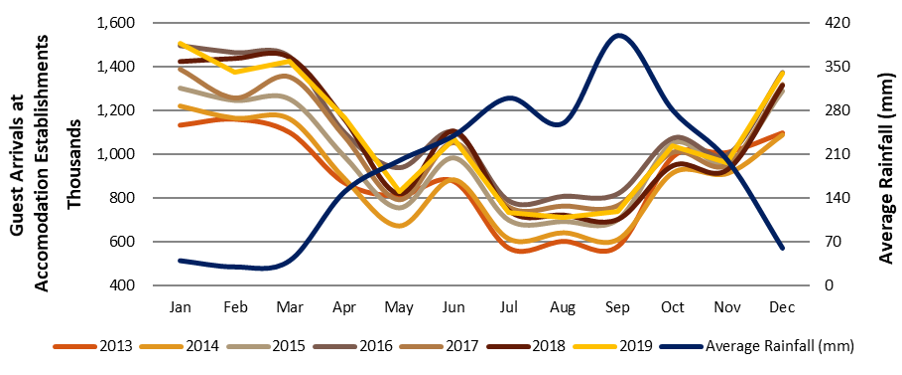

While generally hot and humid throughout the year, Phuket’s seasonality strongly reflects the climate of the island. Based on the seasonality trend in the last seven years, a notable low season can be observed from the end of June to early October, coinciding with the monsoon season. The high season tends to begin around December and lasts until March; this is generally the coolest time of the year. Shoulder seasons can be observed in April, June and October.

Figure 4: Seasonality of Guest Arrivals at Accommodation Establishments vs Rainfall, Phuket, 2012-2019

Source: Department of Tourism

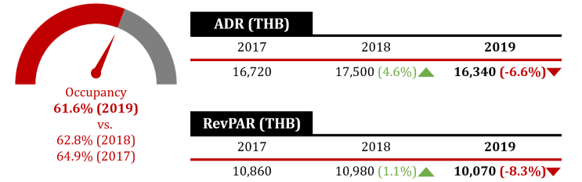

Luxury Hotel Market Performance

Currently, there are approximately 40 branded and unbranded luxury hotels in the market, which account for approximately 3,300 rooms. The aggregate performance of a representative sample of branded luxury hotels of roughly 600 rooms is shown in Figure 5.

Source: HVS Estimates (data includes service charge)

Between 2017 and 2019, the average rate experienced a minor drop of 1.2% per annum, mainly due to a decline of 6.6% in 2019, caused by the strengthening of Thai Baht and the ongoing US-China trade war. Thus, the RevPAR experienced a drop of 3.7% per annum. The occupancy declined by two percentage points in 2018 due to the opening of Rosewood Phuket; however, overall 2018 proved to be a healthy year, recording minor growth of 1.1% in RevPAR, which was mostly driven by an increase in the average rate by 4.6%. Conversely, the performance in 2019 was weaker with a drop in both occupancy and average rate, mostly due to the economic downturn in the market and the refurbishment of Banyan Tree Phuket that added more rooms into the sample size. Looking ahead, demand growth for this sample size might remain subdued in 2022 due to the opening of Mandarin Oriental in Laem Singh Bay.

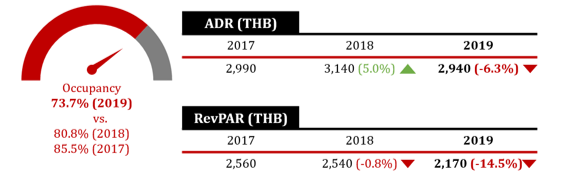

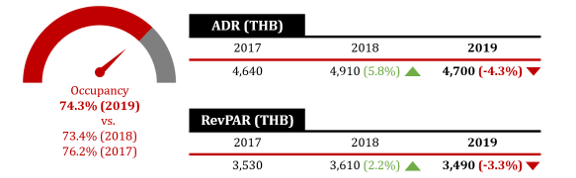

Upscale Hotel Market Performance

The branded upscale hotels in the sample set are mostly situated in the prime areas with direct beach access. Figure 6 shows the aggregate performance of a representative sample of hotels with over 4,400 rooms.

Source: HVS Estimates (data includes service charge)

The upscale hotel market performance fluctuated over the past few years. Between 2017 and 2019, the average rate recorded a minor increase of 0.6% per annum while occupancy levels hovered near the mid-70 percent mark. Occupancy dropped by 2.8 percentage points between 2017 and 2018 and increased by 0.9 percentage points in 2019 partially due to the decline in Chinese tourists following the boat accident during the second half of 2018 and the first half of 2019. Consequently, RevPAR declined by 0.6% per annum over the same period. Additionally, the weaker performance could also be attributed to the strong Thai Baht together with the movement of supply in the upscale hotel market, namely the recent rebranded DoubleTree by Hilton Phuket Banthai Resort of 290 rooms, and the opening of The Mövenpick Myth Hotel Patong Phuket (235 rooms).

Midscale Hotel Market Performance

The midscale market consists of branded hotels with convenient access to the beach of Phuket. Compare to the other segments, midscale hotels in Phuket are more exposed to the wider market performance. Thus, these hotels generally tend to give a discount in rate during the economic downturn to maintain the occupancy levels for the price-sensitive segment. The aggregate performance of a representative sample hotel of approximately 2,000 rooms is shown in Figure 7.

Source: HVS Estimates (data includes service charge)

Midscale hotels registered a healthy performance level in 2017 and 2018; however, a significant decline in occupancy levels was seen in 2019 with a drop of approximately seven percentage points. The average rate among midscale hotels also registered a drop of 6.3% in 2019, resulting in a major decline in RevPar by 14.5% when compared to 2018. Notably, the average rate of midscale hotels in Patong area, which accounted for more than half of the supply in the sample set, declined by approximately 7.2% between 2018 and 2019. The softer performance in 2019 can be attributed to the known key factors, namely the decline in Chinese travellers and the strengthening of Thai Baht. The sample also includes the 255-room OZO Phuket in Kata, which opened in June 2019 and limited growth in the average rate for the sample set. Between 2017 and 2019, given the dynamics of the occupancy level and the average rate outlined, RevPAR posted a decline of 7.9% per annum.

Covid-19 Effect

According to the Ministry of Tourism and Sports (MOTS), the number of tourist arrival in Thailand is expected to decline to 20 million during the first half of the year, which is 50.0% less than the initial estimate. Since the ban of Chinese tour groups towards the end of January, the number of Chinese arrivals fell by approximately 60.5%. During the first week of February, the number of tourist arrival dropped by 43.5% compared to the same period last year, while the Chinese tourists declined by 86.6% during the same period. Following the ongoing travel advisories, the number of tourist arrivals at Suvarnabhumi International Airport witnessed a steep decline of 45.2% by the end of February, compared to the same period last year. The Thai government hasestimated THB300 million lost income from the Chinese market between February and June. The fallout impact on the economy from the COVID-19 is significant and particularly challenging.

The recent outbreak of the COVID-19 has impacted Phuket drastically as tourism is the primary source of income for the province, contributing over THB400 billion to the country’s economy. The outbreak not only affected Chinese tourists but also troubled the whole tourism industry as the public’s initial reactions are to cancel or postpone their trips. As the situation prolongs, the businesses continue to endure losses. According to the President of Phuket Tourism Industry Council and the Phuket Tourist Association’s Vice President of Government Relations, approximately 30.0% of the tourism-related companies could potentially go out of business. Phuket’s local government is pushing for THB20 billion in relief funds to help ease the losses of the business. The fund will be set as a soft loan with an interest rate of 2.0%, similar to what was provided after the tsunami in 2004.

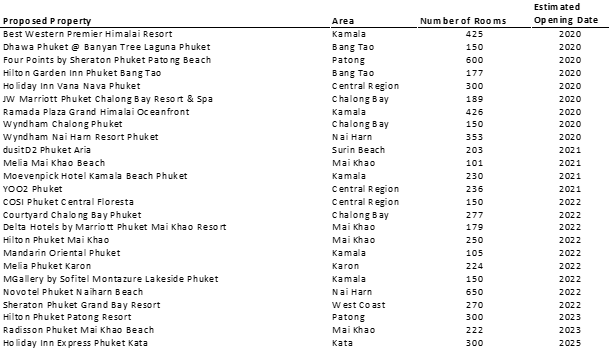

Hotel Supply and Pipeline

Source: HVS Research

According to the Department of Tourism, there were approximately 1,800 hotels with a total of 84,700 hotel rooms in Phuket in 2018. Hotel supply has historically remained stable with modest growth over the last few years. However, there is a significant number of new hotels in the pipeline within Phuket over the next three years. Looking ahead, Phuket’s total room inventory is expected to increase by about 7.8% between 2020 and 2025. Twenty-five hotels with approximately 6,600 keys will be added to the overall room inventory. Renowned international operators will manage much of this new inventory. The majority of new hotels will debut in the Kamala Beach area, accounting for approximately 20.2% of the overall new supply. This could be attributed to the opening of two hotels in MontAzure mixed-use development which features several branded residences and hotels. Several new hotels in the pipeline are also selling to individuals who seek investment opportunity by offering rental programs. These hotels include Dhawa Phuket at Banyan Tree Laguna Phuket, Ramada Plaza Grand Himalai Oceanfront, Best Western Premier Himalai Resort, and MGallery by Sofitel Montazure Lakeside Phuket. Notable projects are listed in Figure 9.

Source: HVS Research, STR

Outlook

Drifting away from mass tourism, the reopening of Maya Bay represents a positive step towards a more sustainable tourism practice in the future. More initiatives have been taken rather seriously to support the growth of the market as the tourism infrastructure on the island has reached capacity. In recent years, Phuket has seen a shift away from the traditional European travellers to regional tourists such as Chinese, Indian, South Korean, and Singaporean. The increase in Indian tourists is expected to help support the market while there is a decline in Chinese tourists in the short-to-medium term.

As of 2020, the future of Phuket looks rather grim, concerning the impact of the COVID-19 epidemic. There is a steep decline in occupancy, as well as a large number of cancellations with a sluggish booking pace. Given the previous scenario of SARS and MERS, the COVID-19 virus has a lower fatality rate, yet the spread is much wider. The heavy reliance on Leisure travel will make a recovery for a tourism destination like Phuket more difficult, in particular, should there be a major knock-on effect on the economies of key source markets.

Growing concerns about the oversupply of hotels and overdevelopment of the island continue to play a factor, with numerous hotels in the pipeline. In the long run, improved infrastructure with light rail and ultimately, the opening of a second airport would expand the existing market and potentially attract new demand from new segments that are previously unexplored. Given the scale of the tourism industry and the province’s dependency, it may be an opportune time for more strategic thinking among the key decision-makers.