Implementation of the 11th Revised Edition of the Uniform System of Accounts for the Lodging Industry

The 11th revised edition of the Uniform System of Accounts for the Lodging Industry (USALI) was published in the spring of 2014, with an implementation date of January 1, 2015. The responsibility for revising the USALI lies with the Financial Management Committee (FMC) of the American Hotel & Lodging Association (AHLA).

Throughout the implementation process, the FMC has received several questions from the worldwide lodging industry. To answer these questions, the FMC has created a Frequently Asked Questions (FAQ) document on the USALI resource portal page of the AH&LA Education Institute’s (AHLEI) website (www.ahlei.org/usali).

In an effort to assist hotel owners and operators with their implementation, the FMC is presenting a series of monthly articles that address some of the most frequently asked questions. Some of the topics to be discussed include gross versus net revenue reporting, service charges, the change from cover to customer counts, mixed-ownership facilities, and operating metrics.

For this month we discuss the increased reporting standards for Labor Costs and Related Expenses. The article was prepared by FMC committee members Ralph Miller and Robert Mandelbaum.

****************************************************************************************************************

Labor Costs and Related Expense Reporting in the 11th Edition of the Uniform System of Accounts for the Lodging Industry

By: Ralph Miller and Robert Mandelbaum

Labor and related costs are the largest single expense items for hotel operations. The combined salaries, wages and benefits paid to employees averages close to 50 percent of total operating expenses. Further, the personal level of service offered by employees is an integral component of the hotel product and guest experience. Accordingly, hotel management spends a significant amount of time controlling labor costs, managing employee productivity, and training personnel.

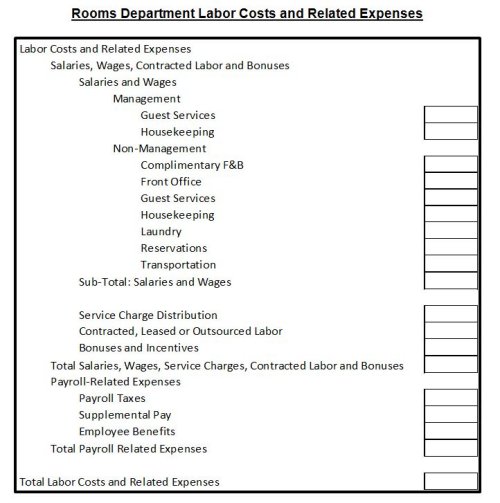

To assist operators with their analysis, and provide more transparency for owners, the 11th Revised Edition of the USALI requires a significantly greater level of detailed reporting of salaries, wages, and payroll-related expenses. The following table presents the new Labor Costs and Related Expenses categories to be presented within the rooms department. Each operated and undistributed department has similar reporting requirements.

In the following paragraphs we describe the additional reporting requirements, and the factors driving the new standards.

- New Terminology: In the 11th Revised Edition the phrase “labor costs” has replaced “payroll costs”. The use of contracted, leased and outsourced labor is growing within the lodging industry, especially in the personnel categories of room attendants, conference/banquet service staff, and spa technicians. The transition from payroll costs to labor costs recognizes the importance of including the costs related to contracting / outsourcing, along with direct payroll costs, in presenting the total departmental costs associated with service delivery.

- Increased Disclosure: The 11th Revised Edition requires that the aggregated salaries of management and non-management personnel be presented within each department. In general, management salaries tend to be more fixed in nature, while non-management wages will vary with business volume. By having a greater understanding of the fixed and variable components, owners and operators gain more insights into the historical and potential future movements of salaries and wages. The data should be presented at an aggregated level that does not disclose any individual person’s salary or wage.

- Service Charge Distribution: The 11th Revised Edition provides enhanced guidance on handling service charges for both the revenue recognition and expense classification. On the revenue side, service charges are classified as Other Revenue in each of the operated departments. Applying the matching principle, service charge distributions are included as a separate classification of Labor Costs in each of the operated and undistributed departments. In the 10th Revised Edition, service charge distribution was included in Payroll Related Expenses as part of Supplemental Pay.

In many jurisdictions service charge distributions have historically been considered the equivalent of a payroll subsidy (there are many minimum wage differentials based on whether a position is considered to be a gratuity vs. non-gratuity position). The 11th Revised Edition classification of service charge distribution as a separate classification of Labor costs effectively includes the cost subsidy, and provides more meaningful comparisons against published industry average operating cost and benchmarking information.

- Bonuses and Incentives: Bonuses and incentives are a separate classification of departmental labor costs and include contractual and discretionary incentive and other types of performance pay. The 11th Revised Edition combines all bonuses and incentives into a single classification, to provide increased transparency. In the 10th Revised Edition, bonuses and incentives were segregated based on whether they were contractual (Bonuses and Incentives) or discretionary (Supplemental Pay).

- Global Terminology: In previous editions of the USALI, payroll taxes focused solely on US centric language and references such as FICA (Federal Retirement and Medicare, FUTA and SUTA (Federal and State Unemployment Taxes, and SDI (State Disability Insurance). Recognizing the global application of the USALI, the 11th Revised Edition identifies examples of common programs in the U.S., the Commonwealth, and other countries. Examples of these programs can be found in Schedule 14.

- Labor Cost Metrics: Recognizing the growing use and importance of statistical analysis within the lodging industry, the 11th Revised Edition provides an expanded chapter for Financial Ratios and Operating Metrics chapter.

Within the Labor Costs Metrics section the USALI presents an optional Consolidated Payroll Cost Statics table that summarizes significant labor cost information for each operated and undistributed department. For each department, the data is presented using the most appropriate metric (i.e. per customer, per available room, per occupied room). In addition, the Labor Costs Metrics section provides nine formulas for the key metrics that can be used to gain a better understanding of a hotel’s largest expense.

The enhanced Labor Costs and Related Expenses reporting standards within the 11th Revised Edition of the USALI provide operators with better operating intelligence and more equitable metrics for benchmarking. Further, owners are provided with greater transparency to a hotel’s largest expense.

****************************************************************************************************************

Ralph R. Miller CPA, CA, CBV, CHA, CHAE is President/Owner of Inntegrated Hospitality Management Ltd. Ralph serves on the AH&LA Financial Management Committee, and is one of the authors of the 11th Revised Edition of the Uniform System of Accounts for the Lodging Industry. Ralph is a former Global President of the Hospitality Financial and Technology Professionals.

Robert Mandelbaum is the Director of Research Information Services for PKF Hospitality Research, a CBRE Company. Robert serves on the AH&LA Financial Management Committee, and is one of the authors of the 10th and 11th Revised Editions of the Uniform System of Accounts for the Lodging Industry.

****************************************************************************************************************

To purchase a copy of the 11th edition of the USALI, and access the nearly 100 questions and answers on the FAQ, or submit your own question for the FMC, please visit www.ahlei.org/usali. This article was published in August 2015 by the American Hotel & Lodging Educational Institute (AHLEI). For detail information visit www.ahlei.org/usali.