January 25, 2022 – Over the past two months, the Omicron variant of Covid-19 has spread across the country further derailing the lodging recovery. While leisure demand remains robust, continued uncertainty surrounding the duration and magnitude of future variants has made it increasingly difficult for corporations to hold return-to-office plans. As such, group and corporate travel has only slowly begun to rebound and it remains unclear how quickly corporate travel will recover to pre-pandemic levels.

Our U.S. industry forecast released on December 1, 2021, acknowledged these challenges, and we had a slightly more positive view of economic activity in 2022 than at present as the Omicron variant has had a larger than expected disruption on supply chains, hiring and general economic activity than had been expected just a couple months ago.

That said, we remain optimistic that the U.S. is pushing beyond the pandemic and perhaps the high infection rates of the Omicron variant will accelerate the transition to post-pandemic recovery.

Leisure travel demand continues to be robust, however as leisure markets begin to compare against the post-vaccine periods of last year, growth is likely to meaningfully slow.

We continue to expect corporate travel to reaccelerate and group travel to strengthen, however we don’t anticipate the strength associated with this past summer’s pent-up leisure demand to persist beyond this winter season. As we move through 2022, we expect there to be markets that materially exceed pre-pandemic levels and other areas that continue to be well behind those levels. We generally expect leisure markets to remain strong while international gateway markets will take the longest to fully recover to pre-pandemic levels.

The recovery may be bumpier than many hope, however we continue to expect several years of unprecedented growth, sparked not only by recovery from the worst freefall the industry has ever experienced, but also by unprecedented levels of fiscal stimulus, savings rates and pent-up demand for travel and new experiences. While we acknowledge the risks tied to remote working and reduced corporate travel, we believe they are offset by more leisure travel and the desire and need to reconnect with co-workers, clients, and peers.

Looking forward, there will be markets that are winners in the coming years and those that end up as losers. Sector participants will need accurate, transparent, and detailed data and information to decipher between them, especially if they wish to take advantage of potential market dislocations that may occur in the near-term.

We believe the best business decisions are based on the best information that is available at the time of determining such conclusions. We take that approach with our forecasts using the best available information to provide the most likely outcome, while acknowledging that with the passage of time, the landscape will continue to evolve and some of the underlying metrics are likely to change. Transparency surrounding forecasting is critical to the lodging industry, which is why we provide complete clarity of our forecasts and how we arrived at them.

It is with that approach that once again LARC exceeded peers in forecast accuracy. In fact, leading into the year, our forecast for 2021 was materially closer to actual results than any other published forecast. While we would have liked to have been closer to the actual results, we believe our relative accuracy in one of the most uncertain times in U.S history highlights the strength in our approach. We expect our forecast accuracy outperformance to continue moving forward.

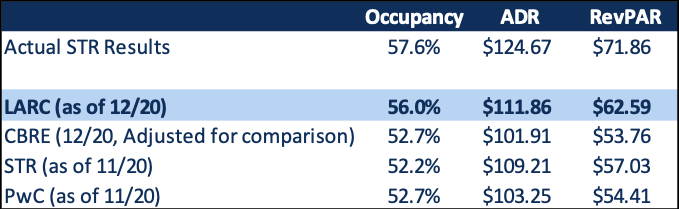

Late 2020 Forecasts for 2021 vs. Actual Results

Source: Lodging Analytics Research & Consulting, JF Capital, Costar

*CBRE data adjusted from Kalibri baseline to STR baseline for comparison purposes

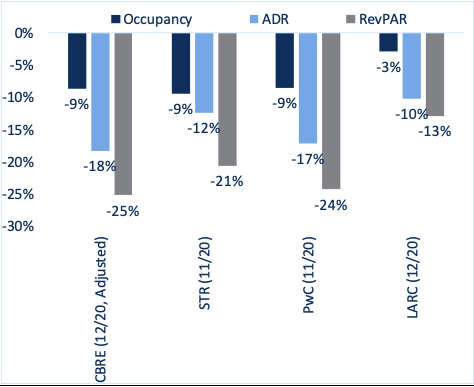

Accuracy of Late 2020 Forecasts for 2021

Source: Lodging Analytics Research & Consulting, JF Capital, Costar

*CBRE data adjusted from Kalibri baseline to STR baseline for comparison purposes

Across the 25 markets LARC released forecasts for in December 2020 for 2021, on average, LARC RevPAR forecasts were off by just 5%, despite the uncertainty headed into 2021.

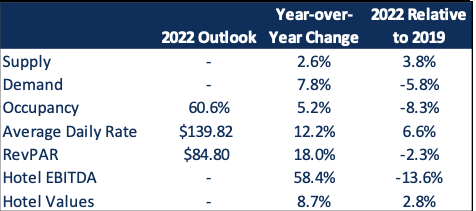

LARC’s Updated 2022 Industry Outlook

Currently, LARC expects U.S. RevPAR to increase by 18.0% in 2022, driven by a 5.2% increase in occupancy and a 12.2% increase in average daily rate. LARC also anticipates U.S. Hotel EBITDA to grow by almost 60% and hotel values to increase 9% in 2022. We continue to forecast ADR and hotel values to recover to 2019 levels in 2022, while RevPAR and Hotel EBITDA will reach 2019 levels in 2023 and occupancy stabilizes slightly below 2019 levels by 2025.

LARC’s Current 2022 Outlook

Source: Lodging Analytics Research & Consulting

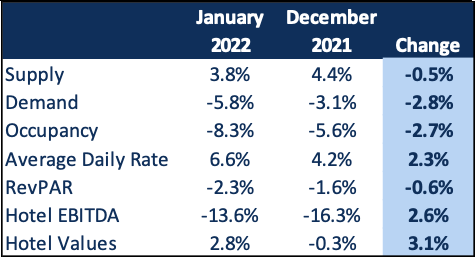

2022 Forecast Revisions

Our 2022 outlook for lodging demand has moderated as the impact of the Omicron variant has been more meaningful on overall economic activity than had been expected in November 2021. However, with most of that impact tied to 1Q-2022, which is the generally the lightest quarter of the year for lodging demand, the outsized impact from the Omicron variant on the 2022 economy will have only a modest impact on the lodging industry. Additionally, ADR growth continues to exceed our expectations, marking this the fourth consecutive outlook incorporating a near-term ADR increase.

2022 Outlook Revision (Relative to 2019)

Source: Lodging Analytics Research & Consulting

LARC’s industry-leading market intelligence referred to throughout this document will assist all industry participants navigate the current environment and position themselves for success as the recovery progresses. Please contact us directly to learn more about our services and products and if there is any other way we may be able to serve you.