From cost per acquisition to qualifying fences and ensuring rate parity with the comp set, Pamela Whitby hears what is keeping three US-based hoteliers awake at night

What keeps hoteliers awake at night? Well that’s “a kind of old and tired story,” says Mark Molinari, Corporate VP RM, Las Vegas Sands. But, he acknowledges, it is a story that keeps on running because of the power that rests in the hands of the few big players which are consolidating to fill gaps in their strategy.

Recently, however, news emerged that fast-growing metasearch Trivago, in which Expedia owns a controlling stake, could pursue an IPO. In analysis from Sally White yesterday, while Expedia says it is not ‘yet’ spinning off Trivago, as it did with TripAdvisor, investors seem confident that it could stand alone.

So, perhaps the OTA-meta lines aren’t blurring as many have argued and instead, as Momondo, Chief Executive, Hugo Burge puts it:, “This is a vote of confidence in a sector which already has a strong track record after a series of high-profile transactions.”

Dan Wacksman, Senior Vice President, Global Distribution, Outrigger Hotels and Resorts is not so convinced:

In my mind meta cost-per-acquisition is really OTA and should be dealt with accordingly Dan Wacksman, Senior Vice President, Global Distribution, Outrigger Hotels and Resorts

Cost of acquisition, driving direct business and keeping up with technology are the three things that keep Wacksman, and a lot of other hoteliers, awake at night. But what is clear is that relationships with every channel a hotel chooses to work with – be it meta, OTA, social or whatever – must be carefully defined. Given the growing hype around meta, this is increasingly important and Wacksman argues that you should “only shift share to this channel when the numbers work”. In other words “don’t be blinded by the argument that metasearch is driving more ‘direct’ bookings. Second time bookers should always come direct to the hotel website”.

Aside from moves by OTA and metasearch players, increasingly established ‘disruptive’ firms like Airbnb are also luring guests away from hotels. And now Airbnb’s foray into the business traveller segment threatens a valuable part of many hotels’ business. According to Airbnb’s Lex Bayer Head of Global Payments and Business Travel: “In 2016, Airbnb tripled in growth and saw nearly 14,000 new companies sign up for ‘Airbnb for Business’ every week.”

If OTAs, metas, disruptors and upstarts aren’t enough of a worry, then there is headache of the wholesale issue. A common scenario is that a hotel sells, say, a ‘room & airfare’ package to their chosen wholesaler – often a big player like GTA or Tourico. This package can then be sold on multiple times ending up with a smaller wholesaler, like Amoma or Travellanda, which then sells only the room night at a much lower rate than the hotel. That's not great for business.

Hotels are rethinking these wholesale relationships and the big chains have whole teams dedicated to reducing their dependency and thrashing out fairer contracts; some like Premier Inn and CitizenM don't work with wholesalers at all. For those, and there are many, that still rely on wholesale business, it isn’t easy.

And yet hotels continue to strengthen their armour in a number of ways. As in the OTA-meta space there have been a flurry of high-profile mergers and acquisitions; Marriott-Starwood, Accor-FHRI, Destination Hotels-Commune Hotels & Resorts to name a few. Accor also splashed out $168 million on OnefineStay in response to growing consumer demand for stays like those offered by AirBnb and this consolidation is likely to continue.

Tools & technology

Although consolidation presents it’s own challenges, and some would argue it isn’t necessarily good for the customer, the good news is that technology and tools are becoming more affordable. Indeed, some hotels are starting to deploy the latest data and analytics tools, which enable them to check, for example, if they are in parity in all their channels.

“This is incredibly important given the importance of price to many customers,” says Lori Weiman, CEO and co-founder, The Search Monitor, a data-driven firm that monitors rate parity and rate fluctuations daily.

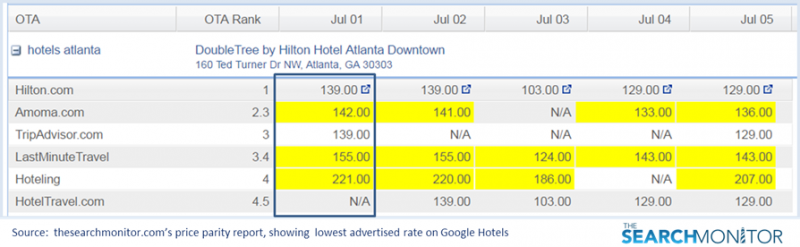

In the graph below, which shows price parity, you can see that the while hotel property owner Hilton has rates lower than the OTAs, the OTAs have rates that are quite different to one another. “The OTAs and the property owner should be monitoring the lowest advertised prices in order to optimise pricing and bookings,” says Weiman. Note that Hilton.com and TripAdvisor have the lowest rates, while Hoteling is much higher.

One of the biggest mistakes hotels make, as Christen Garb, VP RM, Hyatt Hotels, points out in this ‘pricing staples’ story, is to overprice their rack rate, or Best-Available-Rate, and not fully understand what the competitive set is doing.

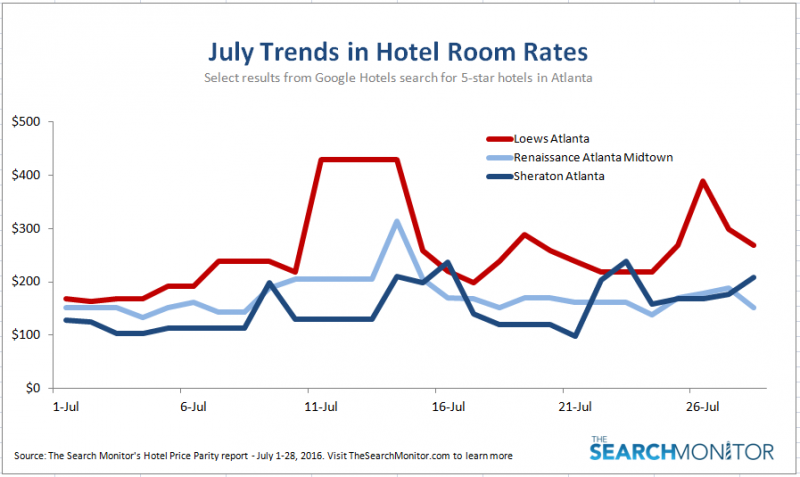

As this second chart showing room rate trends in July for three hotels how room rates for similar properties can often follow their own paths, rather than that of the compset.

All loved up

Another well-documented way that hotels are differentiating is through loyalty programmes, which offer fenced discounts and rewards to club members. This is something that all the big chains are aggressively pursuing but Molinari stresses that ‘fences’, also known as qualified rates, need to be very clearly defined.

Technically, if you send an offer via Facebook to all Facebook members, you could argue that it’s 'fenced' because you have to be a member. “But there are hundreds of millions of members, and historically a fenced discount required a larger commitment from the guest,” he says.

To cite an example, AAA members were eligible for discounted rates, but they had to pay an annual fee. Another is that guests could get a discount for booking a pre-paid, non-cancelable booking. In many cases today, however, all a customer has to do is download an app.

Still, when clearly defined with the right restrictions and with worthwhile rewards they do work. Wyndam is a case in point. Since launching its revamped and simplified programme, it has seen 5 million new members sign up and a 70% uptick in property redemptions – How Wyndham has brought magic to its loyal guests.

Perhaps now the team at Wyndham can now get some shuteye.