Economic uncertainty, an upcoming election and geopolitical tensions to likely impact hotel performance through 2025

Growth in leisure demand has moderated for US hotels. Domestic travelers have continued to seek out experiences internationally and inbound international traffic has yet to recover to pre-pandemic levels. An increased appeal of short-term rentals by leisure travelers has contributed to moderating leisure demand for hotels. Individual business travel and group demand have continued to improve but have still not been able to offset the softening of leisure demand. As a result, occupancy levels have declined year-over-year in each of the past four quarters but are expected to gradually improve through the balance of this year and at least the first half of 2025. Room rate growth played a significant role in the initial recovery for US hotels but began to dampen during the last three quarters of 2023 and continued through Q1 2024.

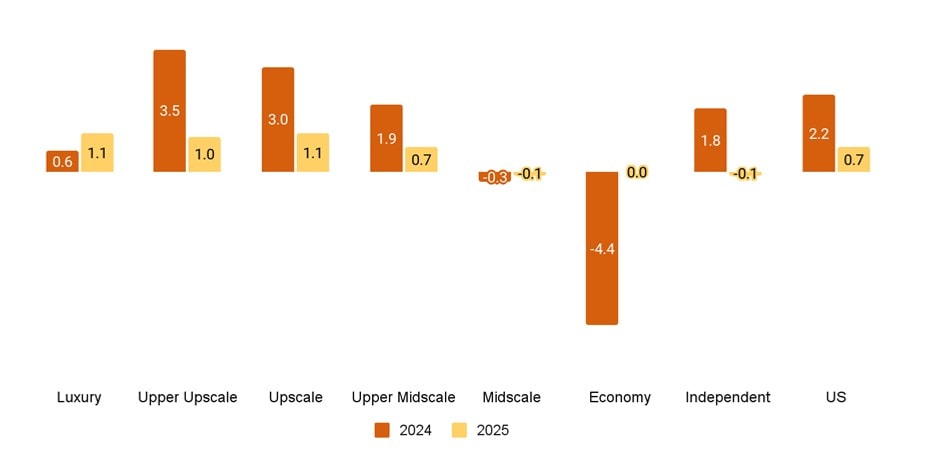

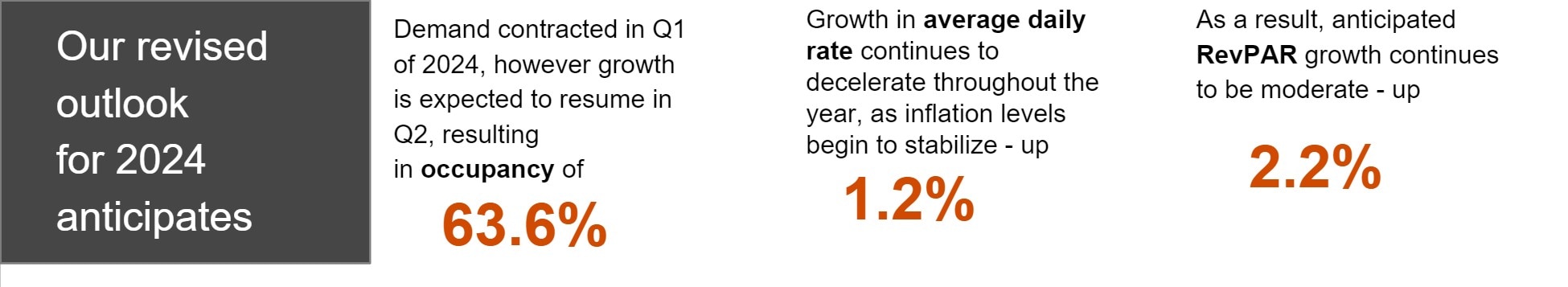

A 50 bp increase in the unemployment rate over the past 12 months (3.4 percent in April 2023 vs. 3.9 percent in April 2024), now speculative reductions in policy rates, and a perceived lack of visibility in the public markets have resulted in downward pressure on room rates. Consistent with our November 2023 outlook, we continue to expect annual occupancy for US hotels this year to increase marginally to 63.6 percent. With moderating growth in occupancies for the balance of this year, we expect average daily room rates to increase 1.2 percent for the year, with resultant RevPAR up 2.2 percent – approximately 116 percent of pre-pandemic levels, on a nominal dollar basis.

“Continued economic uncertainty, an upcoming election and continued geopolitical tensions are expected to impact hotel performance in the US through 2025. Since our last issue of Hospitality Directions US in November, we’ve seen two additional quarters of decline in hotel occupancies, for a total of four, but expect to see a gradual rebound the balance of this year and into next, off of easier comps. That said, we expect average daily rate growth to trail PCE inflation through the rest of this year and 2025.”

Warren Marr, US Hospitality & Leisure Managing Director

Trends and highlights

• Speculation surrounding the Fed’s monetary policy remains top of mind. As recently as April, economic forecasts predicted that a series of rate cuts would commence in June 2024. However, with inflation through Q1 remaining elevated relative to the Fed’s expectations, S&P Global now predicts that a meaningful reduction in rates will not occur until December 2024. With this adjusted outlook, it is unclear whether investors will continue to keep their capital on the sidelines or accept the heightened rate environment as the new norm.

• For the remainder of 2024 and into 2025, the outlook for markets reliant on individual business travel remains uneven with substantial deviation in office attendance across different metropolitan areas. Outbound international leisure travel is expected to continue to outpace inbound, given the relative strength of the dollar. Both occupancies and room rates are expected to experience only marginal growth in 2025, with an expected year-over-year, below-inflationary increase in RevPAR of 0.7 percent – reaching approximately 117 percent of pre-pandemic levels.

• Significant risks to this outlook include the pace of changes in the macroeconomic environment and ongoing geopolitical tensions.

RevPAR percent change, US and chain scales

Source: PwC, based on data from STR