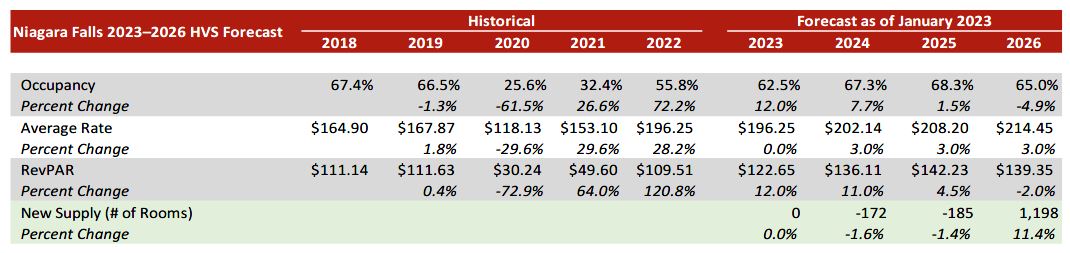

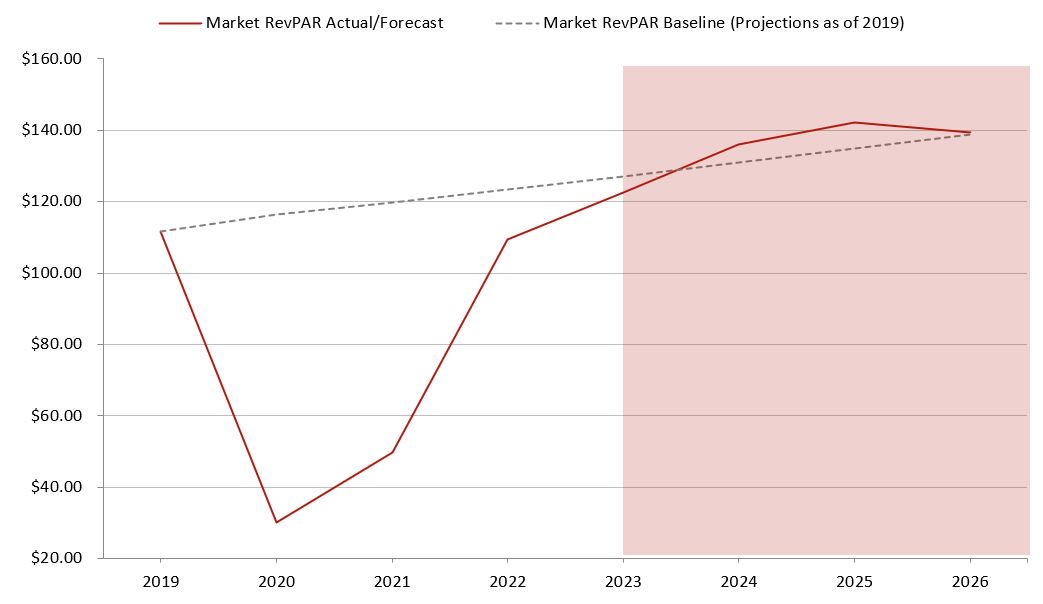

The Niagara Falls lodging market is rapidly recovering after the devastating pandemic-induced RevPAR decline of 72.9% in 2020. The market-wide RevPAR has reached 98% of the 2019 level in 2022 and is projected to reach 110% in 2023. ADR growth is leading the recovery. The cityscape is also poised for transformation over the next ten to twenty years through the addition of high-rise upper-upscale and luxury hotels, many as part of mixed-use developments. This article describes the proposed hotel supply tracked by HVS and discusses the changing demand patterns affecting the RevPAR performance of the Niagara Falls lodging market in the post-pandemic era.

The city of Niagara Falls was one of the hardest-hit lodging markets at the onset of the pandemic. In 2020, the RevPAR went into freefall with a drop of 72.9% relative to 2019, which was the eighth most-severe drop in RevPAR among the 40 largest metro areas in Canada tracked by STR. Many hotels in the area completely or partially suspended operations in response to the sudden absence of demand, although all have since resumed operation. Occupancy levels are expected to remain below 2019 levels in the near term given the timid recovery of large groups and international tours, but local hoteliers are capitalizing on pent-up domestic and US leisure demand by driving rates well above pre-pandemic levels.

HVS has been tracking the performance of the Niagara Falls hotel market from the start of the pandemic through to the current recovery phase. We first present our forecast for the lodging market with a high-level description, and then provide details on the current state of the recovery and changes in market dynamics, which serve as underlying assumptions for our projections of occupancy and average daily rate. Our forecast pertains to the Niagara Region.

Source: STR/HVS

The RevPAR of the Niagara Falls Market is Projected to Surpass the Pre-Prepandemic Baseline Forecast in 2024

Strong Rate Growth is Compensating for Weak Demand Levels in the First Phase of the Recovery

Hoteliers in Niagara Falls are demonstrating a willingness to push room rates. In 2022, the Niagara Falls lodging market sustained an ADR growth rate of 28.2%. This robust ADR performance is partly due to the 2022 Summer Games that the Niagara Region hosted during August; the event is estimated to have generated a $250-million economic impact for the area, benefitting hotels throughout the region.

The strong rate performance contrasts with the lackluster occupancy levels that the market is achieving. Whilst the strong rate growth during 2022, the occupancy performance was down by nearly 10.7 points compared to the pre-pandemic level. Together, these metrics yield a RevPAR recovery of 98.5% for this period. The lingering effects of the pandemic on demand segmentation are driving this trend. The occupancy base for this market has historically been driven by demand from lower-rated tour groups, which is often international. This demand remains greatly depressed. This has undermined the occupancy recovery of the market, but it has also elevated room rates because local hoteliers are focusing on the strong domestic and US transient leisure demand, which has higher room rates, helped by short booking windows. In the near term, room rates are expected to remain strong as hoteliers strive to pass inflated expenses on to the bills of guests. Given the significant volume of event space and the reliance on tour bus demand, which is expected to continue recovering in 2023 and fuel the return of demand segmentation to pre-pandemic levels, the growth in average daily rates is expected to come to an end. Moreover, accommodating the postponed room blocks that were contracted at discounted rates before the pandemic will negatively impact ADR in this market.

Slower ADR Growth, an Occupancy Rally, and New Openings are the Drivers of the Second Recovery Phase

The market dynamics that have prevailed in 2022—depressed occupancy and elevated ADRs—represent the first phase of the recovery. These dynamics are common to tourist destination markets that rely on masses from diverse international origins. With the gradual return of tour buses and events in 2023, our projections account for the beginning of the second recovery phase, which is characterized by the progressive shift in segmentation back to pre-pandemic levels, combined with the related downward pressure on room rates stemming from discounts on room blocks, additional commissions charged by tour operators, and increased booking lead time. As occupancy intensifies through improvements in weekday and low-season activity, however, hoteliers in Niagara Falls will find support to hold on to the ADR gains realized in 2022 while continuing to pass the burden of inflation on to the bills of transient guests; this is expected to act as a counterbalance to the negative impact of the segmentation shift on room rates. As such, flat ADR growth is projected for the Niagara Falls market in 2023. With the gradual reopening of outbound Chinese travel in late 2022, international tour demand is expected to recover significantly in 2023; marking the beginning of the second phase of the recovery which will last until 2024 when the occupancy surpasses the pre-pandemic level of 66.5%.

Niagara Falls is a major tourist destination. Before the pandemic, the city would draw 14 million visitors a year, as well as interest in major tourism investments. Nevertheless, no new hotel supply has broken ground in the city since the opening of the Wyndham Garden Niagara Falls Fallsview in 2011. The highly volatile nature of the leisure demand has made many hotel lenders wary of the area, and many of the proposed projects are large-scale developments that require hundreds of millions for financing, which makes fund sourcing difficult. As a result, the City of Niagara Falls has a long list of dormant hotel development projects that have gone through the planning process and received approval but failed to move forward. We expect many projects to remain dormant in the current unfavourable lending environment; however, a number of projects are scheduled to go through given they will be part of mixed-use developments.

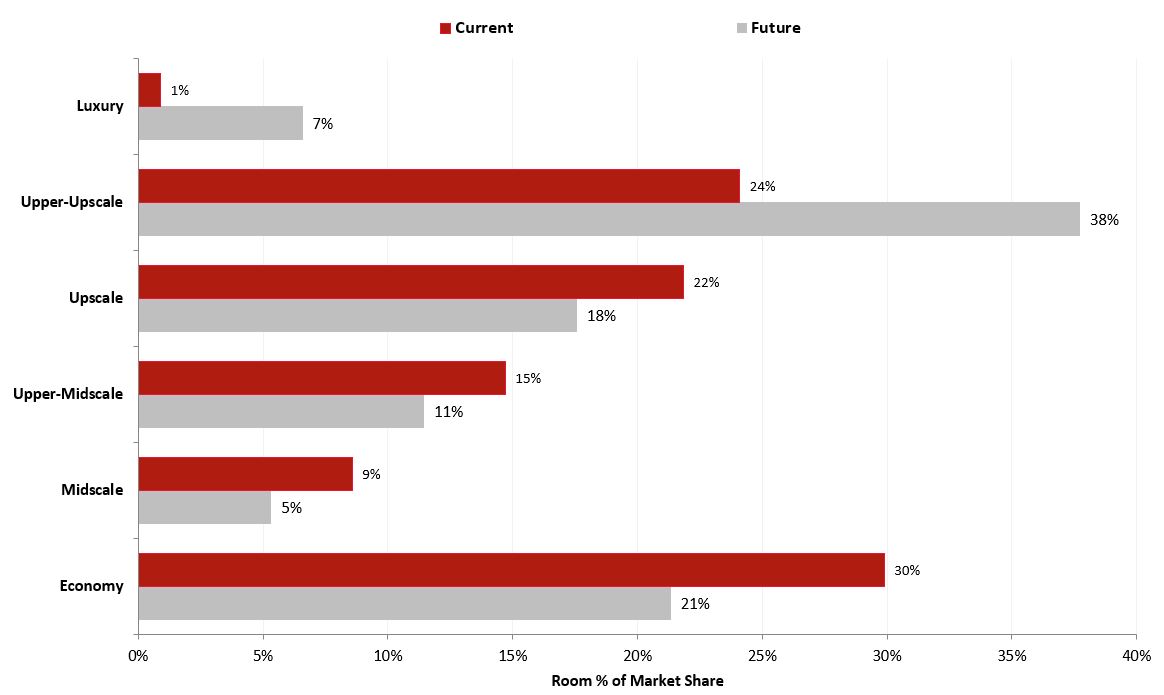

In addition to the dormant projects that were mostly proposed before 2008, HVS is tracking 18 hotel projects that are in various stages of development in the Niagara Falls area, representing more than 6,000 guestrooms. If completed, these projects would transform the Niagara Falls hotel market, as many of these developments involve upper-upscale and luxury properties. Similar to urban downtown locations, the Fallsview tourism district has a high barrier to entry when it comes to major commercial development because land is scarce and expensive. As a result, any hotel development in the district needs to be upper-upscale or luxury in scale to realize the highest and best use of the land.

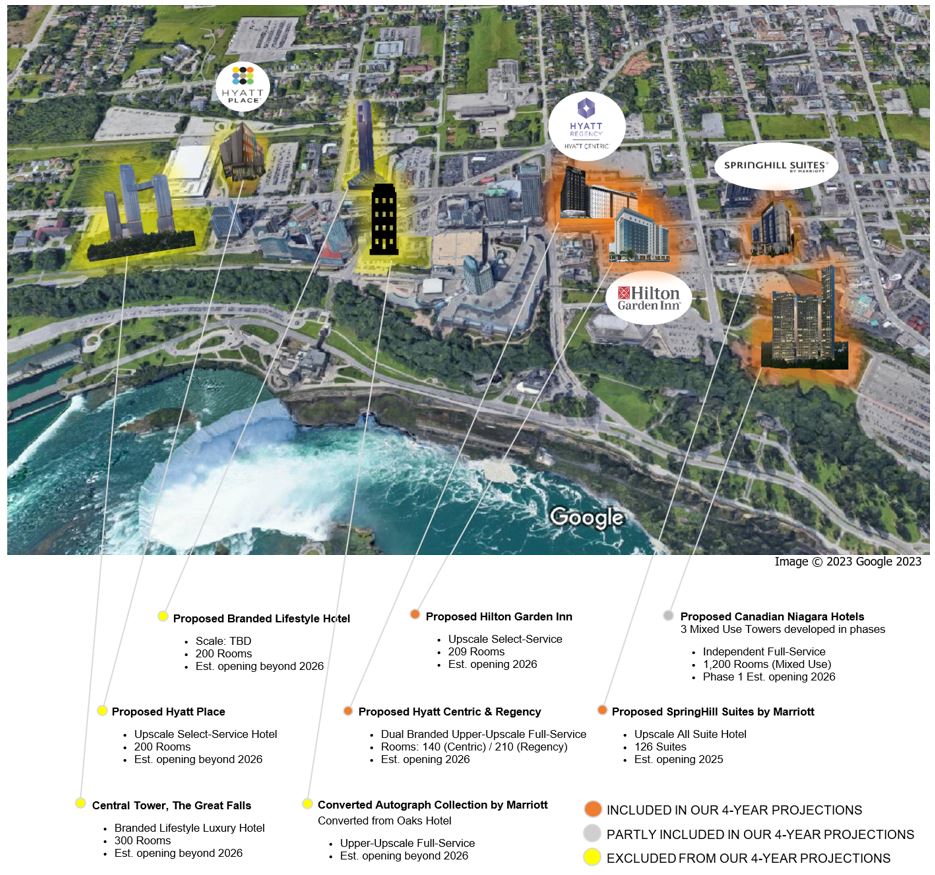

Our four-year market forecast (ending in 2026) assumes the completion of the projects that are highlighted in orange on the New Supply map below. These four hotel developments comprise one independent large-scale mixed-use development and three proposed branded hotels that will bring currently unrepresented product types to the local competitive market.

- The Proposed SpringHill Suites by Marriott Niagara Falls, located on Clark Street, will feature 126 suites and is scheduled to open in 2025. This hotel will be the seventh Marriott-affiliated hotel in the market, and the all-suite inventory will add a product to the market that is highly sought after by families; a prominent segment of the market.

- The Proposed Hilton Garden Inn Niagara Falls is to be developed on the site of the existing IMAX Theatre, located to the west of the Proposed SpringHill Suites by Marriott. This upscale select-service Hilton product is expected to open with 209 guestrooms in early 2026, becoming the fifth Hilton-branded hotel in the market. This property will be a welcome addition given the aging upscale inventory in the market; the last upscale branded development took place in 2004 with the opening of the DoubleTree by Hilton Hotel Fallsview Resort & Spa Niagara Falls.

- One independent hotel development will also play a role in reshaping the skyline of Niagara Falls. Three high-rise mixed-use towers are proposed for a site north of the Skylon Tower. Although the official room count has yet to be confirmed, this project is expected to add approximately 1,800 new rooms and a wide range of supporting amenities and attractions. The first phase of this development is set to open with 900 rooms in 2026, which has been included in our forecast.

- A dual-branded Hyatt Regency and Hyatt Centric property is proposed at the site that is currently improved with the Wyndham Garden Niagara Falls Fallsview (tower 2). The final room count has yet to be confirmed, but we have estimated a total of 350 rooms for this project in 2026. This project would have locational advantages given the proximity to large-scale demand generators, and the unique dual-brand operating profile will drive interest from travellers. Moreover, the proposed hotels will benefit from being the first property associated with the Hyatt system.

The assumed opening of these five hotel developments, and closure of the Wyndham Garden Niagara Falls Fallsview (tower 2) in 2024 and the expected redevelopment of The Oakes Hotel Overlooking the Falls in 2025 result in prorated supply growth of -172, -185, and 1,198 rooms in 2024, 2025 and 2026, respectively.

The following projects are not included in our forecast because their anticipated opening dates fall beyond our forecast horizon. Nevertheless, these projects, which are highlighted in yellow in the New Supply map below, will contribute to shaping the market in the long term.

- The same group that is developing the dual-branded Hyatt Regency and Hyatt Centre is working to bring another Hyatt-branded property in Niagara Falls. The 200-key Hyatt Place is to open adjacent to the 300,000-square-foot Niagara Falls Convention Centre. The opening date for this development project has not yet been published.

- Our occupancy projections also consider the anticipated closure of The Oakes Hotel Overlooking the Falls, which sold in July 2022 and is expected to be converted from an independent hotel to an Autograph Collection by Marriott. Since the opening date for this project has not yet been announced, the supply change from this conversion project is not considered in our forecast. This property transacted in 2022 at an astonishing price of $112.5 million, marking the largest-ever single hotel transaction in the region; the redevelopment potential was the main driver of the high price.

- A $1.5-billion development, a 484-acre mixed-use community called Riverfront Community at Niagara Falls, is proposed for the Thundering Waters area. Upon completion, the development is expected to include 879 dwelling units, 238 senior units, and 500 hotel units. The timeline of this project is currently uncertain. This project was not included in the map above given its location farther away from the Fallsview district.

- Another large-scale mixed-used development is proposed for a site south of the existing Niagara Falls Marriott on the Falls. The Great Falls project is backed by Three Bridges Properties, a Chinese real estate developer. According to the latest communication from the developer, this proposed high-rise mixed-used project will feature three towers with luxurious residences, a luxury hotel, spas, a private club, a cultural museum, and a premier shopping experience. The existing site is improved with a four-storey historic building that is expected to remain in place as per the rendering of the project. The proposed luxury hotel that will be part of this project is expected to feature 300 guestrooms with an anticipated opening beyond 2026. The affiliation status for this project has yet to be announced.

- Lastly, a branded luxury lifestyle hotel is proposed for a site at the intersection of Stanley Avenue and Dunn Street. The site, which is currently improved with a multi-storey vacant structure, is expected to be developed with a 200-key luxury-branded hotel within a mixed-use high-rise building. The opening date for this development project has not yet been published.

If all the hotel projects are completed, the supply landscape will change substantially. At present, upper-upscale and luxury hotels account for 25% of the room supply in Niagara Falls—this would increase to 45% assuming all hotels will move forward to completion.

New Demand Generators, Shifts in Segmentation, and Accommodated Latent Demand are Revamping the Demand Profile of the Market:

- The COVID-19 pandemic has severely affected the Niagara Falls market because local hotels rely so heavily on international transient tourists and tour buses. According to Conference Board of Canada, the area normally welcomes more than 14 million visitors a year, of which 24% originate from US and 8% originate from other international destinations. The reopening of the Canada–US border and the easing of COVID testing restrictions have contributed to a strong recovery of US demand. However, the number of international travellers from other source markets, particularly Asia, is expected to remain sluggish in the near term. Overall, market-wide demand is expected to return to pre-pandemic levels by 2024, supported by the myriad of entertainment facilities in the area, which include professional golf courses, family-style resorts, and brand-name hotels, as well as a $100-million convention centre, the Niagara Speedway, and the North America’s largest elevated go-kart track. Additionally, the new 5,000-seat by OLG Stage at Fallsview Casino that opened in 2022 is a major addition to the tourist attractions in the area, as it will offer more than 300 shows and concerts a year. In comparison, the long-established Avalon Ballroom at the Fallsview Casino Resort can seat only 1,400 people. The new entertainment centre, which is located on Stanley Avenue, is operated by the Niagara Falls Casino Resort and Mohegan Gaming & Entertainment.

- Local hoteliers possess a number of advantages when establishing room rates: (1) transient leisure demand, which makes up more than 80% of the overall lodging demand, has low price negotiating power; (2) being in a world-renowned destination within a 1.5-hour drive from Toronto makes the destination attractive while outbound international travel remains inaccessible and expensive; and (3) the short booking window typically adopted by leisure travellers in contrast to tour buses and conference groups restricts the negative impact of early booking discounts on ADR. The shorter length-of-stay, which is a direct consequence of the pent-up demand from the pandemic spurred by a growing desire to enjoy more frequent but shorter breaks from routine as opposed to a more costly week-long vacation abroad, is also a driver of ADR gains. The market-wide ADR has already surpassed prior peaks, and the area registered an unprecedented ADR of $196.25 in 2022, which is $28.38 higher than the ADR in 2019. However, this significant growth is expected to normalize in 2023.

- A large amount of new supply is expected to enter the market area, but most of the proposed properties have the potential to capture induced demand given the novelty these projects will bring to the local market. Indeed, the three Hyatt-branded hotels will be the first of the Hyatt brand and include the first dual-branded lodging facility in Niagara Falls. In addition, the new supply will allow the market to capture individuals who were previously unable to secure accommodation in the market because all the local hotels are filled. Considering the high occupancy rates achieved by the market over the summer season, Niagara Falls has a significant amount of unaccommodated demand. With the additional lodging facilities that are expected to enter the market, it is reasonable to assume that these guests will be able to secure hotel rooms in the future, thereby adding to the accommodated demand base.

Conclusion

After recording one of the steepest declines in demand in the country during the pandemic, the Niagara Falls lodging market, anchored as it is on a world-renowned tourist destination, has resurged with historic rate hikes, and its RevPAR is now poised to surpass 2019 level in 2023. Nonetheless, the growing shadow of a global recession presents elevated risks for leisure-driven hotel markets, which are typically the most vulnerable when purchasing power deteriorates. The extensive volume of new supply that is in the pipeline for Niagara Falls is set to put a downward pressure on occupancy, but these cutting-edge projects feature new hotel brands and modern products offering unique experiences, which will arouse the interest of travellers in the long term, reinforcing the market’s overall attractiveness. Despite the continuation of some headwinds for demand in the short term, the long-term outlook for the market is positive.

For more information, contact anyone on our Toronto team: Luc Espaillard, Charlie Shi, and Monique Rosszell.