By J. Carter Allen

This article focuses on specific market analysis and data applicable to the development and operation of dual-branded hotels. Much has been written about the dual-brand concept over the last several years, particularly related to the asset type’s benefits and challenges. Instead of providing another such piece that rephrases the same concepts in different ways, this article will focus on data collected from our work with dual-branded hotels over the last several years. While a review of the history of dual-branded hotels and some basic concepts are necessary, this article will hope to provide new data and prove, or disprove, some commonly accepted themes related to dual-branded hotels in the United States.

History

Just as the early 2000s realized the proliferation of the boutique hotel concept, the second decade of the new millennium will arguably be known for the growth of the dual-brand hotel concept. While the concept of dual-branded hotels is not new by any means, the pipeline for these projects has exploded in recent years. Originally, developers maximized the return to a site by developing two hotels, in two separate buildings. While this method allows for some management efficiencies and enables the property as a whole to capture a wider range of demand, it fails to achieve significant development cost efficiency. The model prevalent today is the development of two brands within a single building, thereby allowing the developer to build a denser product that maximizes the return to the land. This pairing of multiple brands within one building allows management to capture a greater range of demand, improving revenue potential while capitalizing on development and management cost efficiencies.

Factors Influencing Development

Many factors must be analyzed prior to developing an opinion as to the highest and best use of a particular site. Demand trends must be identified to determine the timing and use that best fits the site. The potential development of a dual-branded hotel, or multi-branded hotel for that matter, is simply an expansion of the highest-and-best-use analysis. A build-up analysis should be preformed to identify the primary market area. This analysis essentially quantifies the existing demand in a market by estimating occupancy and market segmentation for each hotel in the competitive set and results in a forecast of occupancy for each brand.

Dual-brand hotel developments are most prevalent when the size of the site allows for a hotel with a relatively large room count; however, the market demand analysis would not support a large hotel of a single brand. For example, the demand analysis may suggest that there is not enough demand in the market to support a 225-room select- or limited-service hotel but could support a 125-room select-service hotel and a 100-room limited-service, extended-stay hotel. The ability to build a denser product also delivers more value to the land, which is why dual-branded developments have become popular in urban areas and mixed-use developments where available land is limited.

Dual-branded hotels must work in concert with one another to maximize management’s ability to capture demand and drive RevPAR. The pairing of the two brands is therefore of the upmost importance. The most popular pairings are of select-service and extended-stay hotels under one roof, enabling the developer to offer two different products while maintaining relatively similar chain scales and guest profiles. While this type of development is attractive to developers, and the synergies between the two somewhat comparable brands are significant, substantial design issues can still arise, as the respective amenities and brand identify of each product must be protected.

The Dual-Brand Relationship

As part of our research, we have collected historical occupancy, average daily rate (ADR), and revenue per available room (RevPAR) indices for four comparable dual-branded hotels located throughout the United States. The properties analyzed comprise one select-service hotel and one limited-service, extended-stay hotel. All properties were affiliated with Hilton or Marriott. As one may expect, the occupancy relationship between the select-service hotel and the limited-service, extended-stay hotel within a dual-brand model is typical and similar to how one would anticipate the properties to operate independent of one another. The following table illustrates the typical occupancy, ADR, and RevPAR relationships between the two brands.

Select-Service Brand Commands ADR Premium

The data are consistent with the system-wide differences between Hilton and Marriott’s respective select-service and limited-service, extended-stay brands, which suggest that an extended-stay product would operate four to six points higher in occupancy. However, system-wide data suggest that the extended-stay brand would also perform at a higher ADR, contrary to the data illustrated above. The all-suite, extended-stay package and popular amenity set (specifically, the complimentary breakfast and evening manager’s reception) are primary factors that contribute to this trend on a system-wide basis. The inclusion of hotels in secondary and tertiary markets likely contributes to the difference in data, as the comparable hotels are located primarily in urban areas in strong markets, where the select-service property is able to charge a rate premium.

Accordingly, the dual-brand model is most widely seen in strong markets with high barriers to entry, as management teams can command a rate premium for the select-service property by leveraging multiple demand sources. In weaker markets with less rate differential, the two products become much more competitive, decreasing the likelihood of success. Accurate micro lodging trends, including market segmentation and ADR levels, are necessary to properly understand the rate potential of each hotel separately within the market. The two hotel operations related to the respective brand must be forecast independently of each other and each must have support within the market for occupancy and ADR positioning.

Expense Ratios

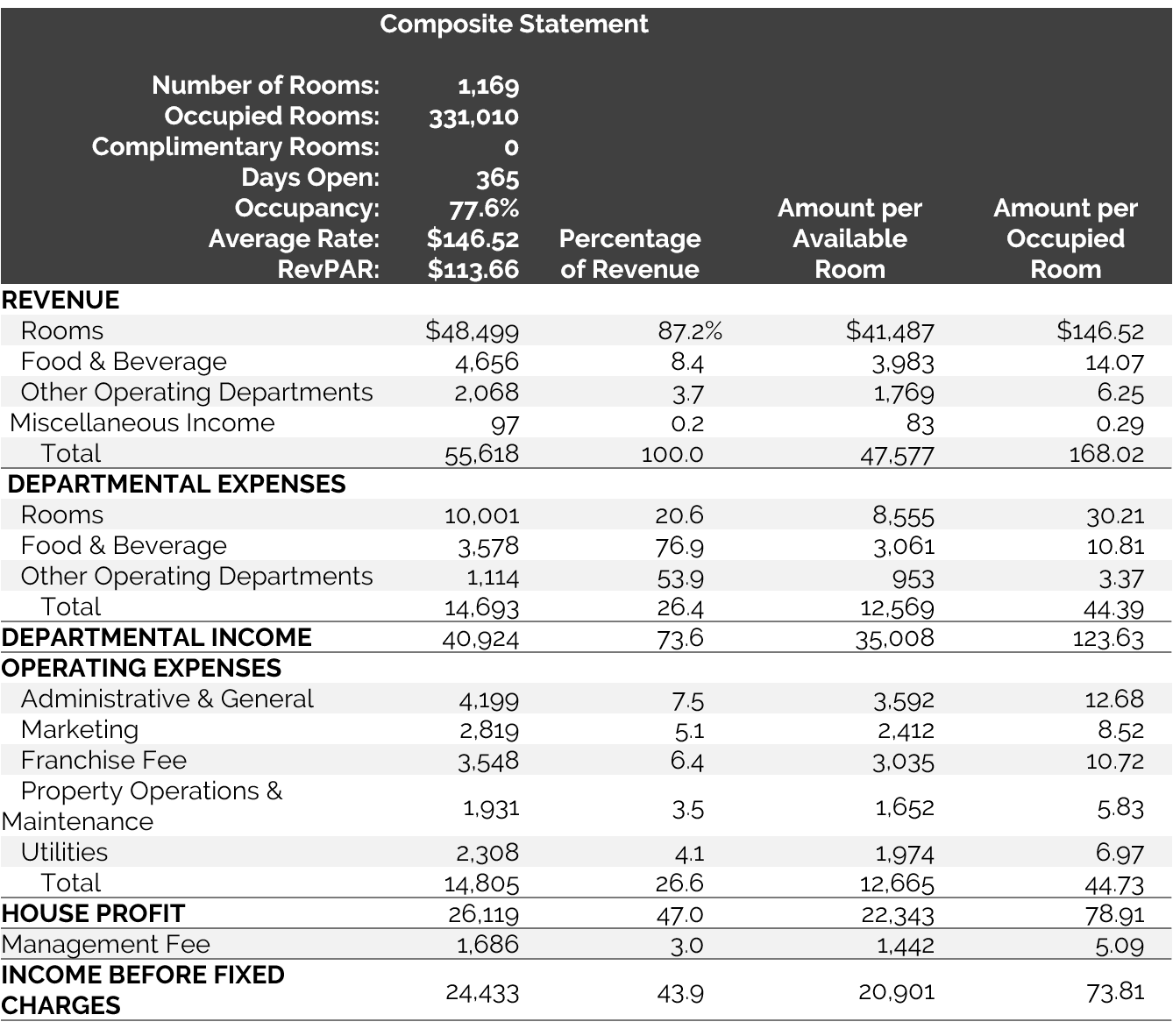

One of the factors that make dual-branded developments attractive is the relatively high yields that investors can achieve compared to other types of hotel development. For example, a developer is able to build a hotel with a room count comparable to a full-service property, but with the operating ratios of a select-service hotel. The higher profit margins compared to a full-service development make the projects more attractive to both debt and equity investors. The following table illustrates the composite operating statement of the four dual-branded hotels analyzed.

The comparable operations achieved a relatively wide range of house profit from 37% to 51%; however, the composite figures are consistent with the aggregate data we collected for the Courtyard by Marriott, Hilton Garden Inn, Residence Inn by Marriott, and Homewood Suites by Hilton brands. Based on an overview of more than 250 operating statements, the four brands combined to achieve a house profit of 46.0%. Separately, the aggregate of the select-service hotels reflected a house profit of 45%, while the extended-stay hotels achieved a house profit of 48%. The data suggest that a dual-branded lodging property should operate at expense ratios consistent with a blended average of what the two brands would be anticipated to achieve individually. Specifically, departmental expenses tend to be more consistent within a ratio-of-sales and per-occupied-room basis, while undistributed operating expenses tend to have a closer relationship on a per-available-room basis.

The operational benefit for dual-branded hotels is realized primarily when the management company can run both hotels and employ just one person for key positions, such as the General Manager, Director of Sales, and Chief Engineer. This seems to be the typical arrangement; however, every project is looked at independently, and some brands may require multiple positions for the property. While hourly employees are generally brand-specific, the ability to cross-train team members can also lead to operational efficiencies.

Conclusions

The dual-brand model offers developers and owners a chance to command a larger share of the market, maximizing potential cash flows and producing a greater return to the land. However, not all sites are best suited for dual-branded hotel development, and accurate market segmentation and demand trends are critical components to success. Moreover, dual-brand projects often require much more time to work through the design process to ensure the protection of individual brand standards and amenities. The benefit of multiple brands is that management is able to leverage multiple sources of demand to drive RevPAR premiums over the competitive set, while maintaining profit levels consistent with select-service operations.

While the size of the dual-brand hotel market is growing at a rapid pace, the number of transactions of this property type is not yet significant enough to analyze differences in investor sentiment. Our conversations with developers, owners, and investors reflect that these assets are comparable to other select-service hotels in similar locations. Exit strategies should be particularly vetted early in the development stage. The unique design of a dual-brand hotel is incredibly specialized and could potentially lead to extensive capital costs when the property requires repositioning.

Reprinted from the Hotel Business Review with permission from www.HotelExecutive.com.