A quick look at macro and micro travel trends in preparation for the fall budget planning season

By Jason Price, EVP, HeBS Digital

Budget season is fast approaching and next month HeBS Digital will publish its annual Smart Hoteliers' Guide to Budgeting for 2018. This popular guide provides hotel marketers with a blue print on where, what, and how for driving the direct online channel and shifting share away from the OTAs. The planning process should take a macro and micro view of the travel economy because the broader market does affect the economic conditions of your local and regional destination.

Moving into 2018, travel supply and demand remains strong and the digital channel will continue to influence selling and purchasing habits. The rise in OTA influence, decreasing brand loyalty, and the drive for personalization will be top influencers in the upcoming year. Be on the look-out for the Smart Hoteliers' Guide – it’s never too early to start planning.

Steady Supply Growth in 2017 and Beyond – Domestic and International

Most metropolitans in the US and Europe are seeing significant hotel room supply growth year over year. “Hotel development is near record levels,” tells Stephen P. Joyce, president and chief executive of Choice Hotels to the Washington Post as he announces 350 new openings globally. Lodging Econometrics, a firm that tracks new hotel builds across the globe, reports robust hotel development activity now and in the upcoming year.

Washington DC is adding an additional 14,000 rooms over the next twelve to eighteen months. Chicago, New York, Miami, Los Angeles and elsewhere are experiencing net new supply. Simply stated, “We’re going through a building boom,” explains Bill Fortier, senior vice president of development Hilton Worldwide to the Financial Times. The growth is across the country and benefit brands and independents. Now is a good time to build.

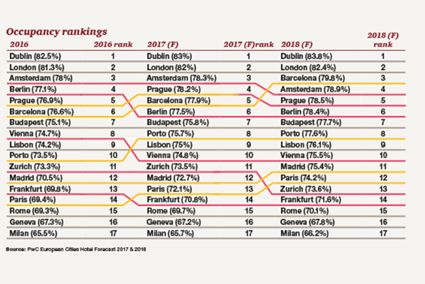

Europe is no different. London and Partners reports 8,000 new room inventory opening in and around London this year alone, a 5.8% increase, and expect an additional 5,000 rooms in 2018. Indeed all 17 European cities tracked in the PWC European Cities Hotels Forecast shows strong growth in room supply with and expected additional 69,000 hotels rooms to come on market by end of 2017, up from over 150,000 in 2016. Hot spots include UK, Germany, Russia, and Turkey.

While great news for the construction worker, mattress supplier, and elevator mechanics, the hotel marketer faces an increasingly competitive landscape.

Strong Demand in 2017 and Beyond

Travel demand remains steady for the remainder of 2017. Business travel remains robust, summer travel appears to have met expectations, and a generation of experience-hungry millennials are opting for travel adventures with their disposable income.

Dublin, Amsterdam, Prague, are popular cities but so too are newcomers like Porto and Budapest both growing in popularity for business and leisure travelers, according to the PWC European Cities Forecast for 2017 and 2018. Paris is facing a nice rebound post politics and terrorism events across France. Analysis from Forward Keys, a company that predicts the number of overseas travel agent bookings to London, forecasts that in the first three months of 2017 bookings from American tourists will go up 25% and up 40% from China, when compared to the same period in 2016. Similar sentiments are expected in North America and may increase given suggestions to a weaker dollar by Q4.

All Travel is Local

All travel is local – just ask the hotelier in Tribeca in NYC, Knob Hill in London, Temple Bar in Dublin or in Cologne, Germany. The hotelier is best positioned to leverage the richness of the local destination. The hotel front desk and concierge can best inform and customize the stay experience. However this unique selling proposition has come under threat. Included in their $60 million annual advertising budgets each for Expedia and Booking are collaborations with local CVB and tourism boards. AirBNB is all about the local experience and, interestingly, seems to capture the imagination of unmanaged business travelers. Business travelers represented nearly 10% of Airbnb total business in 2016 and expect significant growth of the “bleisure” market segment for years to come.

What Lies Ahead for Hoteliers

To win the direct customer starts with a strategic plan matched only by an appropriate budget. The goal is not to outspend Expedia or Booking but to own your local market and win over that direct customer who is dreaming, planning, searching, or purchasing in your destination. A wholesale percent increase or decrease in the budget over the previous year is not the right approach. Data is the new currency so zero in on what your guest data is telling you and leverage this information in your marketing strategies. How well do you know your high value guests? Who are they and find more audiences like them and sell direct when they come to your hotel website. Own the guest acquisition, guest engagement, and guest retention journey that each guest goes through when booking online.

When time comes to map out next year’s plan, consider changes in room supply, economic and demographic shifts to your destination, and influences in travel consumer habits. Match these macro and micro influences with marketing tools and a sound strategy and marketing budget. Work with partners that clearly understand the direction of the industry. The best way to prepare and win the direct customer starts with knowledge. Get your hands on a copy of the soon to be published Smart Hoteliers' Guide to Budgeting for 2018 by HeBS Digital. Let’s go win the direct online customer!