By Mark Adams

California businesses brace for Senate Bill 478‘s impact. SB 478 was signed by Governor Newsom in October 2023 and became effective July 1, 2024. It cracks down on hidden fees, often referred to as “junk fees” and “drip pricing” (because the full cost is only disclosed drip by drip). It will likely change how businesses approach pricing strategies. Many say it is part of a nationwide response to President Joe Biden’s call to eliminate Junk Fees.

What’s in a name? SB 478 or California Junk Fee Law?

The confusion starts with how to reference the new law. Many refer to it by the Senate Bill number assigned when it was first introduced in the California Senate, and the SB 478 moniker continues to be popular with many, even after signed into law.

We also like to call it the California Junk Fee Law because SB 478 does not describe the focus of the legislation. It is really a collection of amendments to the various sections of the California Civil Code, Government Code, and Vehicle Code, as described in more detail below.

Many consumer groups and plaintiffs’ lawyers seem to refer to it as amendments to the California Consumers Legal Remedies Act, or the CRLA. Their focus is on enforcing the law and the remedies given to the government and consumers to bring private legal actions.

Still, others refer to it by the underlying prohibited practices, calling it the California law on drip pricing, hidden fees, bait-and-switch, unfair competition, unfair business practices, consumer fraud, and the like. These advocates generally include California plaintiffs’ lawyers and state and local prosecutors who largely rely on the California Unfair Competition Law (UCL) and the Consumers Legal Remedies Act (CELA) The new California Junk Fee Law is expected to facilitate new claims against businesses under these laws.

We may use all these terms interchangeably, but we tend to prefer the California Junk Fee Law.

What does the SB 478 or the California Junk Fee Law change?

The California Junk Fee Law is a comprehensive act that adds or amends several provisions in various California statutes, including the Civil Code, the Government Code, the Streets and Highways Code, and the Vehicle Code. In particular, SB 478 generally makes these changes:

Civil Code:

- Section 1770: This section amends the California Consumers Legal Remedies Act (CLRA) to explicitly prohibit unfair business practices related to advertising prices that are lower than a customer’s final cost.

- Section 2985.71 (New): Added to define what constitutes a deceptive advertisement regarding pricing.

- Section 1939.20 (New): Added to allow consumers to sue businesses violating new pricing advertisement regulations.

Government Code:

- Section 13995.78 (New): Added to grant authority to the Attorney General’s office to enforce the provisions of SB 478.

Streets and Highways Code and the Vehicle Code:

- New sections were added to both these codes (Sections 36538 & 36638 in the Streets and Highways Code and Sections 11713.27 & 11713.28 in the Vehicle Code) to extend the application of SB 478’s pricing advertisement regulations to businesses operating within these sectors.

Understanding the Impact of SB 478

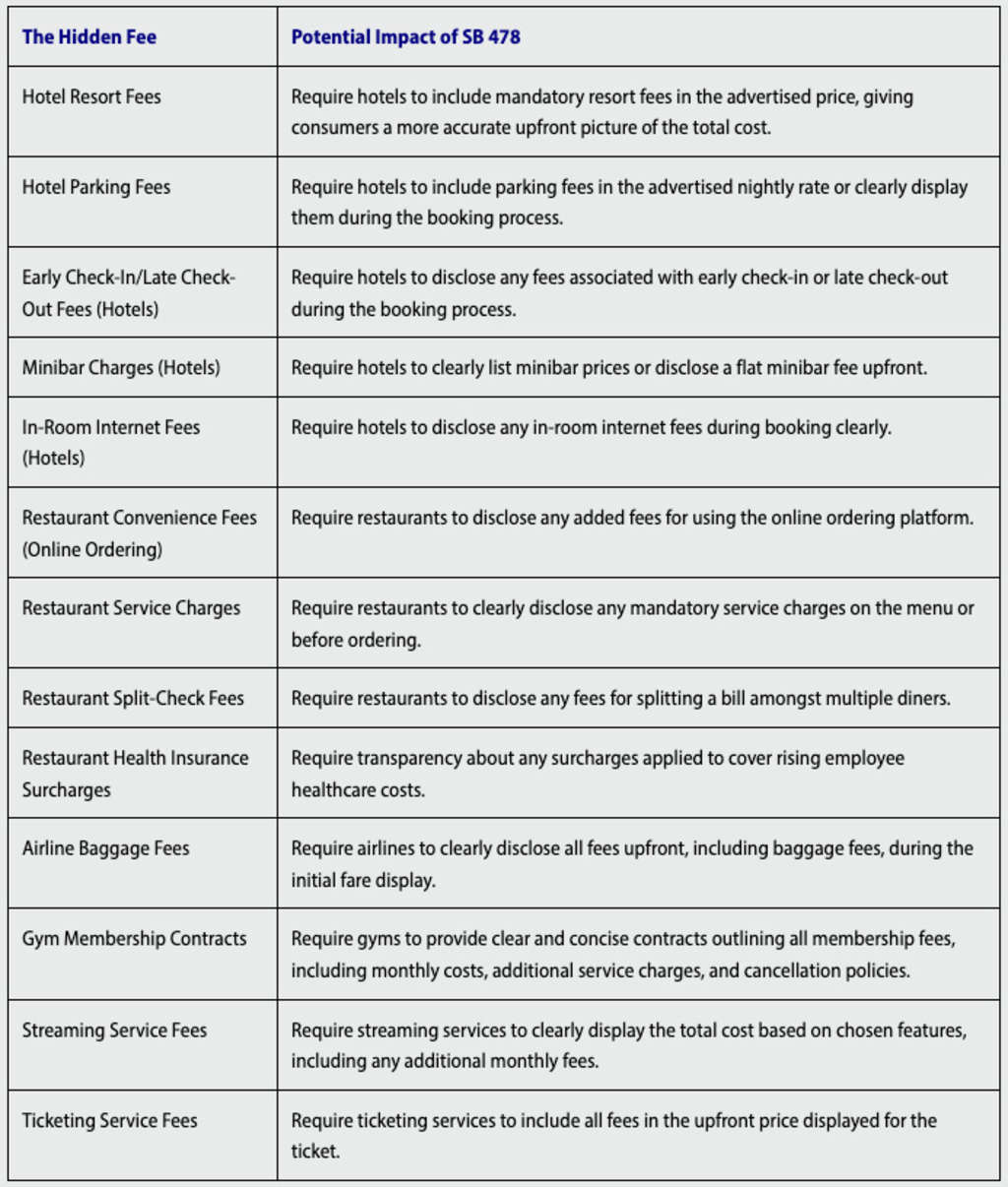

The California Junk Fee Law (as implemented by SB 478) is designed to prohibit businesses from advertising a price that’s lower than the total cost a customer ultimately pays. This means previously hidden fees, such as hotel resort fees, restaurant service charges, convenience fees on event tickets, and mandatory service fees on online orders, must now be factored into the advertised price. However, SB 478’s impact extends beyond just hotels and restaurants. The law’s reach is broad. It applies to many industries and impacts most goods and services offered to consumers in California. This includes things like retail products, event tickets, hotel stays, rental cars, and services like repairs or maintenance. Businesses across various industries may need to review their pricing models. Service providers like plumbers or electricians who charge trip fees might need to bundle them into the base service cost. Gyms with enrollment fees may have to factor those into monthly membership prices. Here are some examples and potential impacts:

The impact of the California Junk Fee Law does not stop at California’s border

SB 478, or the California Junk Fee Law, could potentially extend beyond businesses with a physical presence in California. For example, the law applies specifically to businesses advertising to California residents. So, if an out-of-state company uses online ads targeting California, it would likely need to comply with the California Junk Fee Law because it is actively soliciting business in the state.

And, if a business operates entirely outside California and has a website accessible nationwide, the law might be interpreted to apply if the business has knowledge that a significant portion of their website traffic comes from California and they advertise prices without mandatory fees. But there is also the reality of enforcement – it might be more difficult for California to pursue legal action against a completely out-of-state business with minimal California interaction.

Bottom line: Businesses that advertise online and reasonably expect to reach California residents should be aware of the California Junk Fee Law and ensure their advertised prices are transparent about all mandatory fees (excluding taxes and shipping).

Challenges and Adjustments for Businesses

While promoting transparency for consumers, the California Junk Fee Law necessitates adjustments for businesses. Companies may need to re-evaluate their pricing strategies. Restaurants that relied on service charges might need to raise menu prices to cover staff wages. Similarly, companies selling tickets or booking hotels may have to incorporate mandatory fees into their advertised base price. To comply with the new regulations, businesses must also ensure all advertising and pricing materials reflect the total cost, including mandatory fees.

These adjustments may require significant upfront investments in updating systems and marketing materials, which will be a financial burden for smaller businesses. Additionally, businesses may face customer resistance to price increases, especially if competitors are slower to adapt.

Navigating the Gray Areas

The California Junk Fee Law specifically targets mandatory fees. And while it offers clear guidelines on eliminating hidden fees, some gray areas remain. For instance, businesses may offer optional add-on services that could be bundled with the base price or presented separately. The line between a mandatory fee and an optional add-on service might sometimes be blurry. Businesses may need to clarify which fees are mandatory and which are optional to avoid confusion for consumers. Ultimately, the California Attorney General’s office may need to provide further clarification.

The Transition

Consumers accustomed to seeing a lower advertised price with hidden fees tacked on later might experience sticker shock. This could pressure businesses to find creative ways to communicate the value proposition behind their pricing strategies.

While SB 478 aims to benefit consumers, some industries have already raised concerns. Restaurants, for example, worry that eliminating service charges could make it difficult to maintain wages for tipped staff. The California Restaurant Association is lobbying for an exemption for restaurants that can demonstrate a fair distribution of service charges to employees.

Technology can play a crucial role in helping businesses adapt to the California Junk Fee Law. Point-of-sale systems and online shopping platforms can be updated to automatically factor in mandatory fees and display the total cost upfront. Marketing automation tools can be used to ensure consistent messaging across all advertising channels, reflecting the new pricing structure.

Clear communication will be crucial for businesses as the July 1, 2024 implementation date approaches. Educating staff about the new regulations and ensuring they can answer customer questions is essential. Businesses should also proactively contact customers to explain the changes and address potential concerns.

Industry associations and business groups can be vital in supporting businesses during this transition. Sharing best practices, offering educational resources, and advocating for clear regulations from the Attorney General’s office can help businesses navigate the changes more effectively.

Potential Benefits for Businesses

Despite these initial challenges, the California Junk Fee Law may offer some benefits. Transparent pricing fosters a level playing field where businesses compete based on value, not deceptive practices. Upfront pricing also reduces the potential for customer dissatisfaction and lawsuits arising from hidden fees. Customers who trust they are getting the full picture upfront will likely be repeat customers.

Some businesses may use the California Junk Fee Law as an opportunity to re-evaluate their entire business model. Subscription services with a base fee and additional tiered pricing structures may need to be adjusted to ensure all potential costs are upfront. This could lead to simplified pricing structures and more transparency for consumers.

The need to adapt to SB 478 could spark innovation in the business world. Companies may explore alternative revenue models that don’t rely on hidden fees. Subscription services with clear pricing structures or bundled packages that include previously separate fees could emerge as attractive options for consumers.

The success of the California Junk Fee Law hinges partly on how effectively it’s enforced and how competitors adapt. Businesses that readily embrace transparent pricing could gain a competitive edge. Conversely, those who resist or find loopholes may face customer backlash and potential legal consequences.

Enforcement and Potential Penalties

The California Attorney General’s office will enforce the California Junk Fee Law. Businesses found to be in violation could face civil penalties and potential lawsuits from consumers. Likely, SB 478 is just the first step towards more comprehensive consumer protection regulations in California, as it did with ADA lawsuits. If this law is successful — however that may be measured — it could pave the way for additional laws targeting unfair business practices or surprise charges in other industries. Businesses should be prepared for the possibility of a stricter regulatory landscape in the future.

Looking Ahead: A National Trend

The California Junk Fee Law adds another layer of complexity for businesses operating nationally. With California being a major economic hub, the implications of SB 478 could extend beyond state lines. They may need to implement separate pricing structures for California. This could be particularly challenging for businesses with a strong online presence. Or they could implement similar transparent pricing structures like California’s across all their operations to avoid confusion and ensure compliance.

SB 478 is not alone. It aligns with a national trend towards consumer protection. Similar legislation is being considered in other states, reflecting a growing trend to combat hidden fees.

In January 2017, the Federal Trade Commission (FTC) issued a 44-page report describing so-called drip pricing and concluding that such practices harm consumers and are likely deceptive and misleading business practices that are already illegal under section 5 of the FTCA. See The FTC takes aim at hotel Resort Fees.

After receiving more than 12,000 comments, on October 11, 2023, the FTC proposed a rule on Junk Fees and other related unfair or deceptive practice relating to fees for goods and services.