By David Sangree

In 2022, waterpark owners and operators breathed a sigh of relief as the industry shifted back to normal in the wake of two years of uncertainty. With the pandemic a rearview concern in 2022, most waterparks continued their recovery to see attendance improve. This robust performance paved the way for new growth in all segments of the industry. Several large-scale projects planned for 2023 and beyond will alter the waterpark landscape at both indoor and outdoor waterparks. These projects will continue to encourage existing properties to innovate and update to keep market share.

The industry is also seeing elevated interest in surf parks as both standalone facilities and additions to existing waterparks. As developers compete to be first in many markets, H&LA projects growth in the popularity and development of surf parks across North America in coming years.

While 2023 will be another year of growth for the entire industry, it will still face economic and operational challenges. While the pandemic itself has waned, many of the effects, like labor shortages, wage increases, supply chain issues, and high inflation, seem poised to be part of the new normal for the year.

CURRENT WATERPARK STANDINGS FOR THE U.S. AND CANADA

As of February 2023, the United States and Canada had a total of 1,199 waterparks. Eighteen of those properties opened in 2022, while three properties closed. The majority of these openings were in the outdoor standalone segment, with three new private facilities and eight new municipal/non-profit facilities. There were four new outdoor waterpark resorts, one new indoor waterpark resort, and two new standalone indoor waterparks.

The following bullets break down the numbers regionally for all waterparks in the U.S. and Canada:

- The Midwest and South are home to the most waterparks, with 426 and 400, respectively.

- The Midwest and the South are virtually even in total number of outdoor waterparks with just over 300 each, while Canada has the fewest at 34. Outdoor waterparks in the South typically have slightly longer operating seasons than those in the Northeast and Midwest due to more favorable weather conditions.

- The Midwest leads the U.S. and Canada in indoor waterpark resorts by a large margin with 82.

- The West leads in standalone indoor waterparks with 48, primarily due to the large number of municipal/non-profit indoor aquatic facilities with waterparks in Colorado and Utah.

- The South leads in resorts with outdoor waterparks with 54.

- Indoor waterparks account for a greater proportion of the Canadian market with 40 indoor resort and standalone facilities. Outdoor waterparks number 34.

- Of all hotels with indoor and outdoor waterparks, 46% are affiliated with national hotel franchises while 54% are independent.

- Of all standalone indoor and outdoor waterparks, 31% are municipal/non-profit while 69% are private/for-profit.

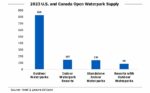

The following chart shows the breakdown of waterpark properties by type out of the 1,199 waterparks in existence:

REVIEW OF 2022 NEW OPENINGS AND EXPANSIONS IN U.S. AND CANADA

Indoor Waterpark Openings: In 2022, eight indoor waterpark openings and expansions added 222,500 square feet of indoor waterpark space, compared to 343,710 square feet in 2021. The higher square footage in 2021 is largely attributable to the addition of the Great Wolf Lodge in Manteca, California, and numerous municipal aquatic centers. In 2022, a larger proportion of new supply came from smaller private facilities.

The number of new resort rooms in 2022 was down significantly from 2021, with only the Crowne Plaza Waterpark Kearney contributing room additions. All other properties focused exclusively on waterpark additions and expansions. Tropic Falls Indoor Waterpark at OWA in Foley, Alabama was the largest new indoor waterpark in this segment with 65,000 square feet. It plans to add a 200-room hotel in 2024. Splash Country Waterpark at Grand Country Inn in Branson, Missouri, and Mt. Olympus Resort in Wisconsin Dells, Wisconsin, both expanded their waterparks by 20,000 and 22,500 square feet, respectively.

Outdoor Waterpark Openings: The year 2022 saw the debut of 11 new outdoor waterparks, all but one of which are run by municipal or non-profit entities. The largest of the outdoor waterpark developments is Wild Rivers Waterpark, which returned to the city of Irvine, California, more than a decade after closing. The original park operated from 1986 until its closure in 2011. The new, 26-acre, $60 million park is located in Irvine’s Great Park and was developed by Mike Riedel and is managed by American Resort Management.

Resorts with Outdoor Waterparks Openings: With only five openings or expansions, resorts with outdoor waterparks had the smallest number of 2022 additions, and was on pace with 2021. The 550-unit Landmark Resort in Myrtle Beach, South Carolina, developed a $3 million outdoor waterpark. The 9,800-square-foot outdoor facility features slides and water play features. The Boca Raton resort in Boca Raton, Florida, completed a $175 million renovation. The updates included the Harborside Pool Club, which features cabanas, pools, a lazy river, five-story water slides, and a kids’ splash zone.

All U.S. Openings: The following map highlights the locations of the 2022 indoor and outdoor waterpark openings in the U.S., inclusive of resorts and standalone properties. It excludes expansions.

The year 2022 saw three waterpark closures: Raging Waters Sacramento in Sacramento, California; Wasserbahn Waterpark Resort in Williamsburg, Iowa; and Wild Water & Wheels in Surfside Beach, South Carolina.

2022 WATERPARK DEMAND

We analyzed weekly visitation compiled by Placer.ai for 10 high-performing properties in the indoor waterpark resort and outdoor waterpark segments.

These indoor waterpark resort venues averaged attendance of nearly 1.5 million each in 2022. While summer was their strongest period, attendance also surged in mid to late February, between the middle of March and the middle of April, and around the holidays in November and December.

These outdoor waterparks averaged approximately 570,000 visitors each in 2022, or more than 1,500 visitors daily. Visitation to these venues is almost exclusively confined to summer months, but parks in Florida are able to open for guests in the off-season, weather permitting.

OPERATIONAL AND ECONOMIC CHALLENGES

Amid robust growth and optimism, there are still several challenges facing the waterpark industry in 2023.

- Labor Shortage: The national labor shortage continues to plague all aspects of the hospitality industry. According to recent figures from the Bureau of Labor Statistics, the industry is still down approximately one million jobs from February 2020. Much of the labor shortfall is in the housekeeping and culinary departments. With unemployment at 3.4% nationally as of January 2023 and visa restrictions limiting the number of immigrant workers, the hospitality industry faces a diminished labor pool. While surveys indicate that wages rate as the most important consideration in returning to hospitality jobs, changes in employment culture, including better flexibility and work-life balance as well as professional development, can serve as powerful incentives to attract employees.

- Wage Increase: The leisure industry has had to come to grips with the fact that competition for labor is not just between waterparks, hotels, restaurants, and attractions. Many employees laid off during the pandemic have moved on and are not expected to return to the industry. Labor shortages forced leisure properties to increase wages as they competed for workers. In addition to marketplace competitive wage increases, 28 states, the District of Columbia, and Puerto Rico have increased their minimum wage since 2019. Additionally, 19 states and the District of Columbia have indexed their minimum wage to inflation, meaning the wage is automatically adjusted each year for increases in prices. Lastly, 46 localities have minimum wages above their state minimum wage. For the waterpark industry, this becomes an ever-increasing challenge.

- Supply Chain Issues: While labor issues continue to take center stage, the abatement of supply chain issues has not yet fully materialized. Developers continue to struggle to get goods from manufacturers abroad. Freight costs have increased and there is no expectation that 2019 prices will return. Supply shocks were not limited to developers, but were also felt in operations as the availability of goods has been impacted. Pre-planning and remaining nimble are the needed ingredients for successful projects and operations over the next year.

- Inflation: The Consumer Price Index (CPI), which measures the cost of a basket of goods and services, peaked at 9.1% in June 2022. Year-end CPI numbers have measured inflation at 8% for 2022. While the number is currently trending down for 2023, it is still well above the Federal Reserve’s target inflation level of 2%. The Federal Reserve’s policy to combat inflation is to raise interest rates. Since March 2022, the Federal Reserve has raised its benchmark interest rate by 450 basis points from 0.25% in March 2022 to 4.25% in February 2023, the highest level in 15 years. The goal is to calm the inflationary drive, which is eating into consumer purchasing power, without causing a recession. While inflation and higher interest rates may or may not spark a recession, they are putting pressure on the construction lending markets. Banks and debt lenders have become more selective as the higher construction costs are placing pressure on leverage.

PROJECTIONS FOR 2023

For 2023, we will see growth across all segments of the waterpark industry with projected openings of 22 facilities in the United States and five in Canada. We also anticipate expansions of 20 existing facilities. Regionally, the South leads the U.S. with eight projected openings, followed by the Midwest with seven. The Northeast has four projected openings, and the West will see three openings. Overall, the number of projected openings is slightly higher than in 2022. The following map highlights the locations of the properties.

Indoor Waterparks: With projections of 472,399 square feet of new indoor waterpark space and 1,047 new rooms, the indoor waterpark segment will see significant gains over 2022. The following bullets describe major projects scheduled to open in 2023.

- Great Wolf Resorts will debut its new $300 million resort in Perrysville, Maryland. Located adjacent to the Hollywood Casino at the Chesapeake Overlook development, the property will offer 700 guestrooms and a 126,000-square-foot indoor waterpark. Beyond 2023, the company is developing additional resorts in Texas, Tennessee, California, and Connecticut, making it the most growth-oriented brand in the indoor waterpark resort space.

- A $100 million waterpark adjacent to the Showboat Atlantic City hotel and casino in Atlantic City, New Jersey, is scheduled to open Memorial Day weekend. This 103,000-square-foot property will feature dining, shopping, and waterpark attractions including a lazy river, 11 slides, and pools housed under a retractable glass roof. The developer, Bart Blatstein, aims to provide non-gaming, family-oriented entertainment. The venue is being touted as the world’s largest indoor beachfront waterpark.

Outdoor Waterparks: Growth in the outdoor segment will continue with 11 new standalone waterparks anticipated. Many existing waterparks are investing in modest to large expansions in 2022. Highlights include the following:

- Phase one of the $10.5 million Serengeti Springs at the Hattiesburg Zoo in Hattiesburg, Mississippi, includes the Fusion Fortress play structure, multiple slides, lazy river, swim-up bar, and cabanas.

- Waterslide additions at Aquatica Orlando; Rapids Waterpark in Riviera Beach, Florida; Waldameer & Water World in Erie, Pennsylvania; and Water Country USA in Williamsburg, Virginia.

Resorts with Outdoor Waterparks: There are four planned expansions or new developments of resorts with outdoor waterparks in the United States in 2023. Highlights include the following:

- JW Marriott Phoenix Desert Ridge Resort & Spa in Phoenix, Arizona, will complete an $18 million renovation, adding a pool, slide tower, and cabanas.

- A $30 million expansion at Country Cascades Waterpark Resort in Pigeon Forge, Tennessee will feature new guestrooms, restaurants, and waterpark renovations.

Surf Innovations: New innovations continue to be developed for the waterpark industry, including multiple new man-made surfing facilities. The leading companies in this space include Wavegarden, Citywave, American Wave Machines, Surf Lakes, and SurfLoch/WaveLoch. We expect to see additional opportunities for consumers to enjoy surfing on artificial waves in the coming years as developers work to construct multiple projects.

Surf parks appeal to a wide range of customers in various life stages, including families with children. Surf parks can capitalize on that in much the same way waterparks have by creating family-friendly environments coupled with memorable experiences. This will increase the reach and scope of the sport in a way that may lead to dramatic growth in coming years.

Surf parks have strong developer interest in North America and throughout the world. The following table shows the number of surf parks proposed or under construction. These do not include projects in very preliminary stages.

The United States could see six new surf parks open in 2023 in Arizona, California, South Carolina, Texas, and Virginia.

CONCLUSION

Putting the pandemic far in its rearview mirror, the waterpark industry is poised to show improvement in 2023. Many indoor waterpark resorts outperformed traditional hotels during the past 12 months due to their strong leisure demand from families. There are new waterpark resorts proposed and under construction throughout the United States. New standalone waterpark projects are also projected to open both indoor and outdoor waterparks by municipal and private developers. In addition, surf parks are seeing robust interest from developers and investors as the number of properties under construction and proposed continues to increase. As the market remains strong for development, financing challenges, inflation, and labor costs will remain a concern and may dampen some opportunities.

Though these external challenges could hamper some development, the fact that we continue to see so much growth and expansion is proof that the industry remains strong and revitalized. Owners, operators, and developers have adapted to the changes over the last several years, paving the way for another successful and exciting year. While the waterpark industry has not changed in essentials, we are excited to see further innovation and adaptation as the industry pushes the boundaries of entertainment and immersive fun.