- World’s top 50 hotel brands valued for the first time

- Data shows Hilton is the most valuable individual brand

- Marriott-Starwood merger will create world’s most valuable hotel brand portfolio

- For now, Hilton Worldwide remains the most valuable group

Every year, leading brand valuation and strategy consultancy Brand Finance scrutinises thousands of the world’s top brands. They are evaluated and ranked to determine which are the most powerful and valuable and grouped into league tables by country and industry.

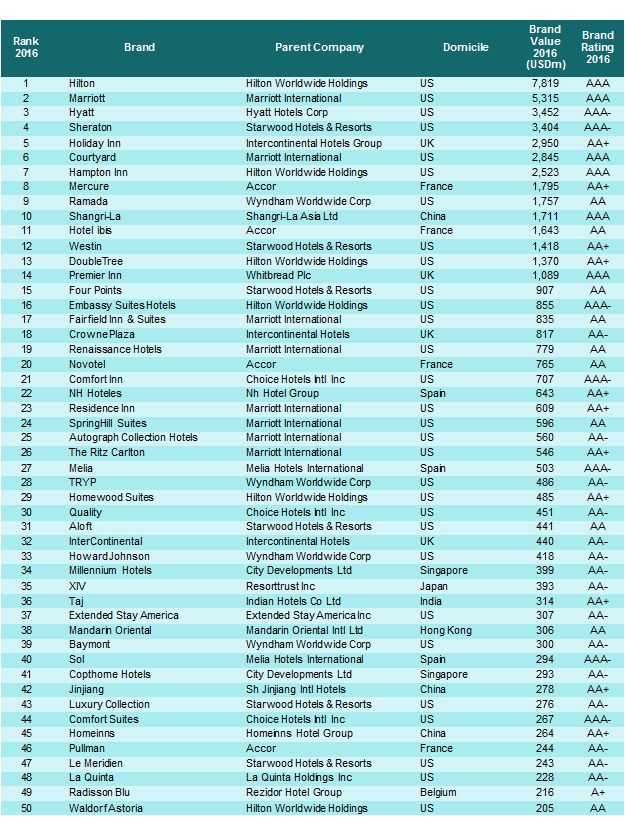

The top 50 hotel brands by value comprise the inaugural Brand Finance Hotels 50. Hilton is by far the most valuable brand, with a value of US$7.8 billion up by a third on last year’s value of US$5.8 billion. Hilton is also the most valuable group in the table. Six Hilton Worldwide brands feature in the top 50, totalling US$13.3 billion from Hilton at the top of the table to the Waldorf Astoria, which props up the bottom of the table in 50th. This is a hugely impressive feat for a brand with just one location. Its brand value stands at over US$200 million.

Marriott is in second place with a brand value of US$5.3 billion. Its group has even more brands in the top 50 than Hilton, with 8 in total, however their combined value is lower, at US$12 billion. Having already acquired the Delta group of hotels, Marriott is attempting to merge with Starwood, the third most significant group by brand value, its six brands being valued at US$6.7 billion.

This move will create the world’s biggest hotel group with the most valuable brand portfolio.

Brand Finance Chief Executive David Haigh commented, “As disruptors such as Airbnb create an ever more challenging environment for traditional operators, a new wave of investment from the likes of Anbang Insurance Groups is to be welcomed, however frustrating it may seem. Brand investment in particular is key in this fast-changing environment.”

The World’s Most Valuable Hotel Brands

2016 brand values are calculated in USD with a valuation date of 1/1/16.

Methodology

Definition of Brand

In the very broadest sense, a brand is the focus for all the expectations and opinions held by customers, staff and other stakeholders about an organisation and its products and services. However when looking at brands as business assets that can be bought, sold and licensed, a more technical definition is required. Brand Finance helped to craft the internationally recognised standard on Brand Valuation, ISO 10668. That defines a brand as “a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos and designs, or a combination of these, intended to identify goods, services or entities, or a combination of these, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits/value.”

However, a brand makes a contribution to a company beyond that which can be sold to a third party. ‘Brand Contribution’ refers to the total economic benefit that a business derives from its brand, from volume and price premiums over generic products to cost savings over less well-branded competitors.

Brand Strength

Brand Strength is the part of our analysis most directly and easily influenced by those responsible for marketing and brand management. In order to determine the strength of a brand we have developed the Brand Strength Index (BSI). We analyse marketing investment, brand equity (the goodwill accumulated with customers, staff and other stakeholders) and finally the impact of those on business performance. Following this analysis, each brand is assigned a BSI score out of 100, which is fed into the brand value calculation. Based on the score, each brand in the league table is assigned a rating between AAA+ and D in a format similar to a credit rating. AAA+ brands are exceptionally strong and well managed while a failing brand would be assigned a D grade.

Approach

Brand Finance calculates the values of the brands in its league tables using the ‘Royalty Relief approach’. This approach involves estimating the likely future sales that are attributable to a brand and calculating a royalty rate that would be charged for the use of the brand, i.e. what the owner would have to pay for the use of the brand—assuming it were not already owned.

The steps in this process are as follows:

1. Calculate brand strength on a scale of 0 to 100 based on a number of attributes such as emotional connection, financial performance and sustainability, among others. This score is known as the Brand Strength Index.

2. Determine the royalty rate range for the respective brand sectors. This is done by reviewing comparable licensing agreements sourced from Brand Finance’s extensive database of license agreements and other online databases.

3. Calculate royalty rate. The brand strength score is applied to the royalty rate range to arrive at a royalty rate. For example, if the royalty rate range in a brand’s sector is 0-5% and a brand has a brand strength score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4. Determine brand specific revenues estimating a proportion of parent company revenues attributable to a specific brand.

5. Determine forecast brand specific revenues using a function of historic revenues, equity analyst forecasts and economic growth rates.

6. Apply the royalty rate to the forecast revenues to derive brand revenues.

7. Brand revenues are discounted post tax to a net present value which equals the brand value.