As digital marketers, we always focus on return on investment (ROI) and return on advertising spend (ROAS). It’s a core indicator across any vertical and a key expectation of any hotel owner or management company.

But what if we turned that expectation upside down? What if we focus on the bottom line impact and net operating income (NOI) instead of the top?

Over the past decade, I’ve had the luxury of working for the smartest hoteliers and owners in the business and there is one question I consistently get asked: “10:1 ROAS is great, Michael, but is it incremental and is it impacting the profit line?”

Two really tough questions rolled into one. Now that I am on the SaaS side of the hotel business, I want to break this down and address these two areas.

Breaking it down

First, let’s set a baseline. For this study, I will refer to a real-life example of a well-known hotel brand in North America (which I will call Hotel Origami for this scenario) which has a $200k annual digital marketing spend.

Why branded vs. an independent? In my opinion, it’s the toughest to prove. Brands have a well-established distribution network and already pay for brand marketing initiatives.

There is also the prevailing industry sentiment of “Why would I spend additional money on digital marketing when I have brand ads running already? What else do we really need?” I call this “the build it and forget it” mentality.

Now let’s first look at the media mix and year-to-date (YTD) results of Hotel Origami’s digital marketing investment:

The YTD results here are positive, led by paid search, in particular, branded terms. Display results here are very strong, driven for this hotel by remarketing, travel intent and behavioral campaign performance, both view-through and click-through (we will address the view-through and attribution later in the piece).

Now that we have a clear picture on the top line impact, we can move to the bottom line.

Seeing the big picture

To really understand the bottom line impact, we must first look at the whole picture: total costs, digital marketing needs, sales and marketing, labour, franchise fees of Hotel Origami etc.

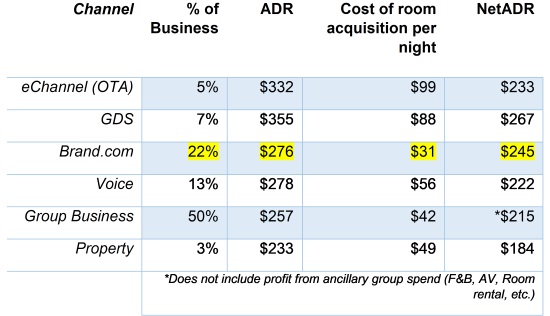

Working with the Cendyn Business Intelligence team and strategists, we have developed a modeling tool that, with some basic reports from the hotel and a few numbers from the P&L, create a dynamic look at the channel costs and calculates the Net ADR.

This will tell us how the digital marketing spend impacts the ADR of HotelOrigami.com. The brand dotcom is typically the most profitable channel where your digital marketing efforts are focused.

The tool also highlights where the opportunities lie to maximise profit across other channels.

I’ve imported the reports and P&L items into the tool and this is what we know today about Hotel Origami.

Deconstructing the mix

Let’s first look at the digital marketing impact on brand.com. While brand.com is not the highest ADR, it is the second highest NetADR and cheapest to acquire by $11 per room night. More importantly, brand.com NetADR is $12 higher per room night than the OTA’s – which means every night we can shift from the OTAs to brand.com is $12 more profit, straight to the bottom line.

Another interesting item to note here is GDS. While only accounting for 7% of business and with a high acquisition cost, it still carries the highest NetADR by $22.

I’d expect the sales team to take a hard look at this channel, identify who or what is driving business at an ADR of $355 and then get aggressive on finding more of it themselves.

Now that we know we are positively impacting HotelOrigami.com with our digital marketing efforts and where we are driving the highest NetADR, let’s look at incrementality.

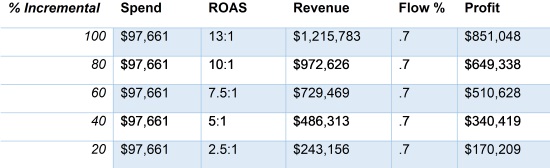

To get to a reasonable percentage, we need an attribution model. For Hotel Origami we will use a seven-day cookie window and a position-based (40/20/40) attribution model. This model gives 40% credit to the first click, 40% to the last click and 20% credit to every click and/or action in between.

If we look back at the media mix, we have display ads running which have notoriously low click-through rates and view-through impressions, which a lot of branded asset owners do not give much credit to today as it’s hard to track “views” to revenue.

Let’s lay out the results and assess.

Agreeing on a model

We all know that $1.2 million is not all incremental revenue, especially in a branded hotel. But the tricky part is finding a percentage that your owner and agency agree on. Add in a conversation about which attribution model to use and I promise you will have a lively, but very important conversation.

For this hotel and owner, we are using the 40% model. It’s important to note that although not perfect, these data points help us make smarter decisions at the budget table on both digital marketing spend and segmentation/channel impact.

Bottom line impact

The overall media mix is driving 13:1 ROAS The $1.2 million YTD revenue is positively impacting brand.com with a NetADR of $245, driving $12 more profit per room night than the OTAs.

Looking at the incrementality model, the ROAS is still 5:1 while only taking credit for 40% of the business

The incremental profit impact YTD from this hotel’s digital marketing spend using the 40% measurement is $340k

Imagine if you had multiple hotels and could budget your digital marketing dollars against the bottom line instead of the top? Would you invest more knowing you are actually driving asset value vs. topline impact? We believe this is the future of digital marketing and want to show you what it means for your hotels and resorts.

Complimentary analysis

For a free assessment of one of your digital marketing assets using our Digital Marketing Impact Analysis tools, fill out the form below to connect with one of our analysts who will follow-up to schedule a complimentary evaluation. You don’t have to be a current Cendyn client to take advantage of this offer.